Energy companies must apply for our approval to begin an energy development project or activity in Alberta. Every year, we receive about 40 000 applications, including everything from requests to access a parcel of land, to requests to drill a well, to requests to build a pipeline. Regardless of the request, we share applications with Albertans and encourage public participation in our decision making.

We are moving towards a single-system, one-stop approach for processing applications, which will change the way companies submit applications to us. Visit our Integrated Decision Approach page to learn more.

Improving Our Application Processes and Timelines

Energy developments are complex, and the process a company must follow will vary based on the type of project or activity it is proposing.

We continually evaluate and update processing times as we improve efficiency in our application review processes. This is done without affecting public involvement or the protection of public safety and the environment.

The following graph shows how we’re performing against our targets. For details on each application type, see the full applications timelines report. [Tableau]

Each application is reviewed to ensure our technical experts have the information they need to make a decision on the application within our estimated timelines.

We make every effort to process applications within our estimated times—and in most cases we do. However, in some cases it might take longer to review an application because the development is complex or because of factors beyond our control, such as incomplete applications or stakeholder or indigenous consultation requirements that have not been met.

Learn more by selecting one of our application processes.

| Application Process | Description |

|---|---|

| Long-Term Gas Removal Permits | We authorize a company’s removal of natural gas in Alberta under the Gas Resources Preservation Act (GRPA). We issue gas removal permits to control the amount of gas leaving the province, and conserve natural gas resources for Albertans. |

| Measurement Accounting and Reporting Plan (MARP) Authorizations | A company with a thermal in situ oil sands project must measure, account for, and report its oil sands, crude bitumen, derivatives of crude bitumen, and oil sands products. It must do the same for products obtained or used in the recovery of oil sands, crude bitumen, and oil sands products. Section 20(1)(k) of the Oil Sands Conservation Act governs the methods the company can use, as well as the standard conditions for converting measurements. |

| Modifications to Existing Oilfield Waste Management Facilities | Companies must apply to modify an existing oilfield waste management facility. This application is governed by section 15.212 of the Oil and Gas Conservation Rules. |

| New Oilfield Waste Management Facilities | Companies must apply to construct and operate new oilfield waste management facilities in Alberta. |

| New Well Base Maximum Rate Limitation (Form O-38) | Allowables, or maximum rate limitations (MRLs), are production rate controls applied mainly to oil pools or oil reserves according to Directive 007-1: Allowables Handbook—Guidelines for the Calculation of Monthly Production Allowables in Alberta. |

| Nonroutine Public Involvement Authorizations | Companies must submit a nonroutine public involvement application for wells, facilities, and pipelines when the Directive 056 consultation or notification requirements have not been met, or there are unresolved concerns or objections. |

| Nonroutine Technical Authorizations | Companies must submit applications for wells, facilities, and pipelines under Directive 056: Energy Development Applications and Schedules when technical requirements will not be met, a variance from regulatory requirements is requested, or the use of new technology is proposed and there are no outstanding concerns or objections. |

| Off-Target Penalties | We may apply an off-target penalty against a company’s producing gas or oil well if it is completed outside of the prescribed target area in its drilling spacing unit (DSU). A well licensee can apply for an off-target penalty against a well if the well is off-target towards an applicant’s land containing a well capable of producing from the same pool, and the off-target well is producing. |

| Oil Sands Exploration | We regulate the use of public land in Alberta for oil sands exploration activities under the Environmental Protection and Enhancement Act and the Public Lands Act. |

| Oil Sands Mining Authorizations | We regulate oil sands mining-related activities in accordance with the Oil Sands Conservation Act, and we classify applications for these activities into five types. |

Listening to Concerns

If someone believes that they will be directly or adversely affected by a proposed project, they have a right to be heard by the AER. We share project applications on our Public Notice of Application page for 30 days (unless otherwise specified), which helps anyone who is concerned about a project find and understand the development plans.

We encourage anyone with concerns to submit a statement of concern for us to consider during our review of the application. If the statement of concern is relevant, complete, and submitted on time, we will consider the concerns while we decide to approve or reject the company’s application.

If we’ve already made a decision on an application, and someone believes that they may be directly and adversely affected by this decision, they may be qualified to request an appeal of our decision. Learn more about our regulatory appeal process.

Application Legislation

Provincial legislation, including the Mines and Minerals Act, Public Lands Act, Environmental Protection and Enhancement Act, and Water Act, shapes our requirements and approval processes. Learn more about these acts and what we regulate under them.

Unpaid Municipal Taxes

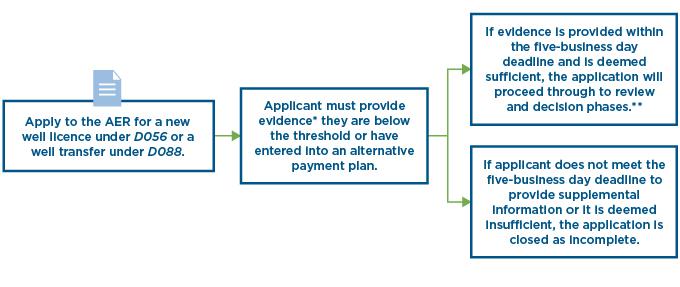

* As per Bulletin 2024-22 evidence includes a letter signed by the Chief Administrative Officer of the municipality on the municipality’s letterhead or a valid tax certificate. For well transfer applications where the transferor exceeds the threshold, the evidence includes a letter signed by a director or an officer of the company containing a verbatim citation of the condition within the purchase and sale agreement showing payment of municipal taxes owed as a condition of the purchase and sale agreement with the transferee.

** Each application submitted will follow normal application process and timelines (which may include additional SIRs and conditions where applicable).

The Statement of Concern (SOC) Process Q&As

Q1: Should I file a statement of concern (SOC) if I know an applicant does not meet the requirements outlined in Bulletin 2023-22?

Any stakeholder that has specific concerns regarding a company’s proposed energy development may submit an SOC. For an SOC to be considered, it must relate to an active application currently before the AER. Since all new well licence and well licence transfer applications will be assessed in accordance with Ministerial Order 043/ 2023 and Bulletin 2023-22, applications that fail to meet the set criteria will be closed and no longer considered active. This will result in the subsequent closure of any associated SOCs to that application.

Q2: What happens if I have concerns regarding an applicant whose municipal tax arrears are below the threshold?

If you have specific concerns about a company’s unpaid taxes, regardless of the threshold, you may submit a statement of concern (SOC). If your SOC is relevant, complete and submitted on time, the AER will take the concerns into consideration when reviewing the company's application. An SOC should clearly and concisely describe how you would be directly and adversely affected by the approval of the proposed activity, the nature of your objection, and the outcome you seek.

For more information about the SOC process, visit our Statement of Concern page.