Updated June 2025

In this section

Highlights of 2024

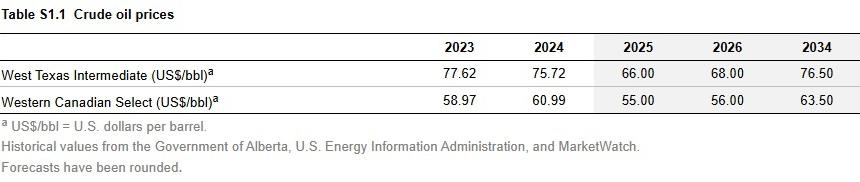

WTI: The West Texas Intermediate (WTI) price decreased by 2.4%, averaging US$75.72 per barrel (bbl) in 2024. The decrease was mostly due to concerns about weak global oil demand growth, while global oil supply was relatively stable.

WCS: The Western Canadian Select (WCS) price increased by 3.4%, averaging US$60.99/bbl. The increase in the WCS price contrasted with the percentage decline in WTI due to increased export capacity, resulting in the price differential narrowing in 2024 compared with the previous year.

Price differential: The differential between WTI and WCS declined from US$18.65/bbl in 2023 to US$14.73/bbl in 2024.

Table S1.1 shows historical and forecast prices for crude oil.

Highlights of 2025 to 2034 - Short-Term Tariff Uncertainty Scenario (Base Case)

Market Factors:

Global crude oil prices are expected to decline in 2025. The uncertainty surrounding U.S. trade policy and the threat of U.S. tariffs against Canada and other countries is expected to weigh on crude oil demand throughout the first half of 2025. The decision by the Organization of the Petroleum Exporting Countries and its allied non-member countries (collectively referred to as OPEC+) to increase their crude oil supply starting in April 2025 further weighs on global oil prices, including the WTI price. Geopolitical tensions and new U.S. sanctions on Russia, Iran, and Venezuela are expected to offset the downward pressures on oil prices.

In addition, the WTI price base case forecast is influenced by demand-side factors, such as weak global demand growth and fears of a possible recession. On the supply-side, it includes production growth in non-OPEC+ countries, including the U.S., Canada, Brazil, and Guyana. By 2026, global demand is expected to improve as trade tensions ease, global economic growth accelerates, and transportation fuel demand in India rises. However, continued non-OPEC+ production growth will limit price gains. By 2027, a modest increase in WTI prices is anticipated due to rising crude oil demand.

The long-term forecast largely depends on the demand for petroleum liquid fuels. Despite advances in environmental policies, there is still uncertainty if there will be a decline in global crude oil demand.

WTI: The WTI price is forecast to average US$66.00/bbl in 2025, increasing to US$68.00/bbl in 2026. The price is expected to increase to US$76.50 by 2034.

WCS: The WCS price is forecast to average US$55.00/bbl in 2025, rising to US$56.00/bbl in 2026. The price is expected to increase to US$63.50/bbl by 2034.

Price differentials: The price differential between WCS and WTI reflects transportation costs, crude quality, regional supply and demand balances, and infrastructure constraints. Under the base case, the WCS and WTI price differential is anticipated to average around US$11.00/bbl in 2025. This is due to improved market access to Pacific markets and oil sands turnarounds in the first half of the year, which temporarily reduced bitumen production. Despite this, increased volatility caused by U.S. trade policy uncertainty is expected. As uncertainty eases and production rises in 2026, the differential is expected to widen to US$12.00/bbl. The differential is anticipated to stabilize at US$13.00/bbl from 2027 onwards.

Highlights of 2025 to 2034 – One-Year Tariff Scenario (Tariff Case)

Despite diplomatic efforts, Canada is unable to avoid the U.S. tariffs. We have assumed a 10% tariff on Canadian energy products and a 25% tariff on other goods starting in the first half of 2025. The U.S. has implemented additional tariffs on China, the European Union, and other major trading partners. Canada and other U.S. trading partners will respond with tariffs on the U.S. Under this scenario, the tariffs between Canada and the U.S. are assumed to remain in place for 12 months before mostly being phased out in 2026. All other crude oil supply and demand assumptions are unchanged compared with the base case price forecast.

WTI: The WTI price under the tariff case is expected to average US$60.00/bbl in 2025, increasing to US$62.00/bbl in 2026. The price is anticipated to strengthen to US$70.00 by 2034.

WCS: The WCS price under the tariff case is expected to average US$45.00/bbl in 2025, rising to US$48.00/bbl in 2026. The price is anticipated to increase to US$57.00/bbl by 2034.

Price differential: The price differential between WCS and WTI is expected to widen under the tariff case to US$15.00/bbl in 2025. As tariffs ease in 2026, the differential is expected to narrow to US$14.00/bbl and stabilize at US$13.00/bbl over the remaining forecast period.