Updated June 2025

What is Lithium

Lithium is considered the lightest of all metals and the lightest solid element under standard conditions. Lithium extraction and processing methods vary depending on the source material:

- lithium-bearing rocks (e.g., spodumene ore),

- clay,

- seawater,

- subsurface brines (i.e., geothermal, oil and gas field brines), and

- recycled electronics.

Globally, most lithium is produced by the precipitation of lithium-containing salts from shallow underground brine reservoirs or by rock-hosted mining. In Alberta, lithium is in deep-formation waters often associated with oil and gas reservoirs. Based on current geological knowledge, the areas with the most potential are Devonian-aged carbonate reservoirs in west-central and southern Alberta. The Alberta Geological Survey (AGS) is undertaking a program to expand the publicly available geoscience data for emerging resources, including lithium.

Companies and research groups in Alberta are testing direct lithium extraction (DLE) technology. This technology allows access to Alberta's lithium-brine potential found in existing oil and gas reservoirs, enabling the recovery of lithium concentrate, which is the first step in the value chain.

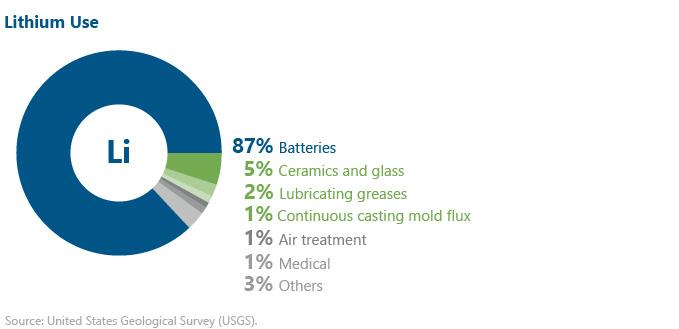

Batteries for electronics and electric vehicles drive global lithium demand, followed by ceramics and glass. The following figure shows the primary uses of lithium.

Demand for lithium is expected to increase as the demand for electric vehicles (EVs) powered by lithium-ion batteries is projected to grow. Consumers will likely purchase EVs to reduce fuel costs and take advantage of improved battery technology or for environmental reasons.

Federal and Provincial Critical Minerals Strategy

The federal government has included lithium on Canada's critical mineral list due to its role in economic security and transitioning to a low-carbon economy. Critical minerals are vital to growing Canada's clean, modern economy and are essential for clean technology applications, renewable energy, defence and security technologies, agriculture, and medical applications. In 2022, the federal government released Canada’s $3.8 billion, eight-year Canadian Critical Minerals Strategy to increase domestic extraction and production of lithium and other critical minerals. The federal government has invested in E3 Lithium to advance Canada’s EV battery production through the federal Strategic Innovation Fund Net Zero Accelerator initiative and the Critical Minerals Research, Development and Demonstration Program. Building sustainable infrastructure is also a key component of the Canadian Critical Minerals Strategy. The Government of Canada has been accepting applications under the Critical Minerals Infrastructure Fund (CMIF). The CMIF supports the development of infrastructure projects that will enable and grow the sustainable development of critical minerals.

Alberta’s Mineral Strategy and Action Plan was released in November 2021 and aligns with the federal government’s strategy. The Government of Alberta has expanded the mandate of the Alberta Energy Regulator (AER) to include mineral resource development. The Mineral Resource Development Act establishes the AER as the regulator of mineral resources. Alberta has extensive geological data and expertise to enable the development of Alberta's lithium resources to capitalize on increasing demand. Lithium companies that invest in research and development in Alberta are eligible to apply for the Alberta Innovation Employment Grant, a refundable tax credit. Alberta Innovates is another financial incentive program that supports research and innovation by providing expertise, services, and funding to postsecondary researchers, entrepreneurs, and industry.

Production in 2024 and Base Case and Forecast

Currently, there is no commercial lithium production in Alberta. However, E3 Lithium plans for commercial production of 5.7 thousand tonnes of lithium from 23 producing wells starting in 2027. The production and well forecasts involve weighing the risks based on the likelihood of the project meeting its commercial start date and production capacity. Total lithium production in Alberta is forecast to rise to 14.8 thousand tonnes by 2034 (see Figure S9.6).

Potential uses of lithium in Alberta include industrial applications, such as the chemical production of lithium carbonate and lithium hydroxide, mainly used in manufacturing lithium-ion batteries.

Projects

Several companies in Alberta have announced projects:

- In June 2024, E3 Lithium released a summary of key results from its pre-feasibility study for the Clearwater Project based on the DLE field pilot. In January 2025, they successfully produced battery-quality lithium carbonate from Leduc brines with demonstration-scale equipment in a laboratory. The lithium brine demonstration facility will replicate the functionality of a small-scale commercial system and will be operational in 2025.

- NeoLithica will drill two brine wells in 2025 for comprehensive reservoir engineering evaluations. The wells will provide the brine needed to conduct a pre-commercial pilot for its Peace River project. The pilot facility is expected to be operational in 2025. NeoLithica will develop an aquifer management plan and commission a pre-feasibility study once the pilot ends.

- LithiumBank’s Boardwalk project DLE pilot brine-testing facility started in 2024 with brine sourced from four wells. The pilot will focus on testing their DLE technology, emphasizing concentrate quality, flow rate, and lithium recovery.

Alberta Resource Potential

Lithium brines have been recognized in Alberta's oil and gas reservoirs since the early 1990s1, when companies identified high lithium concentrations in brines of the Devonian Leduc and Swan Hills Formations. More recent studies2 indicate that additional Devonian geological units, such as the Nisku and Wabamun, may also be viable targets for lithium extraction .

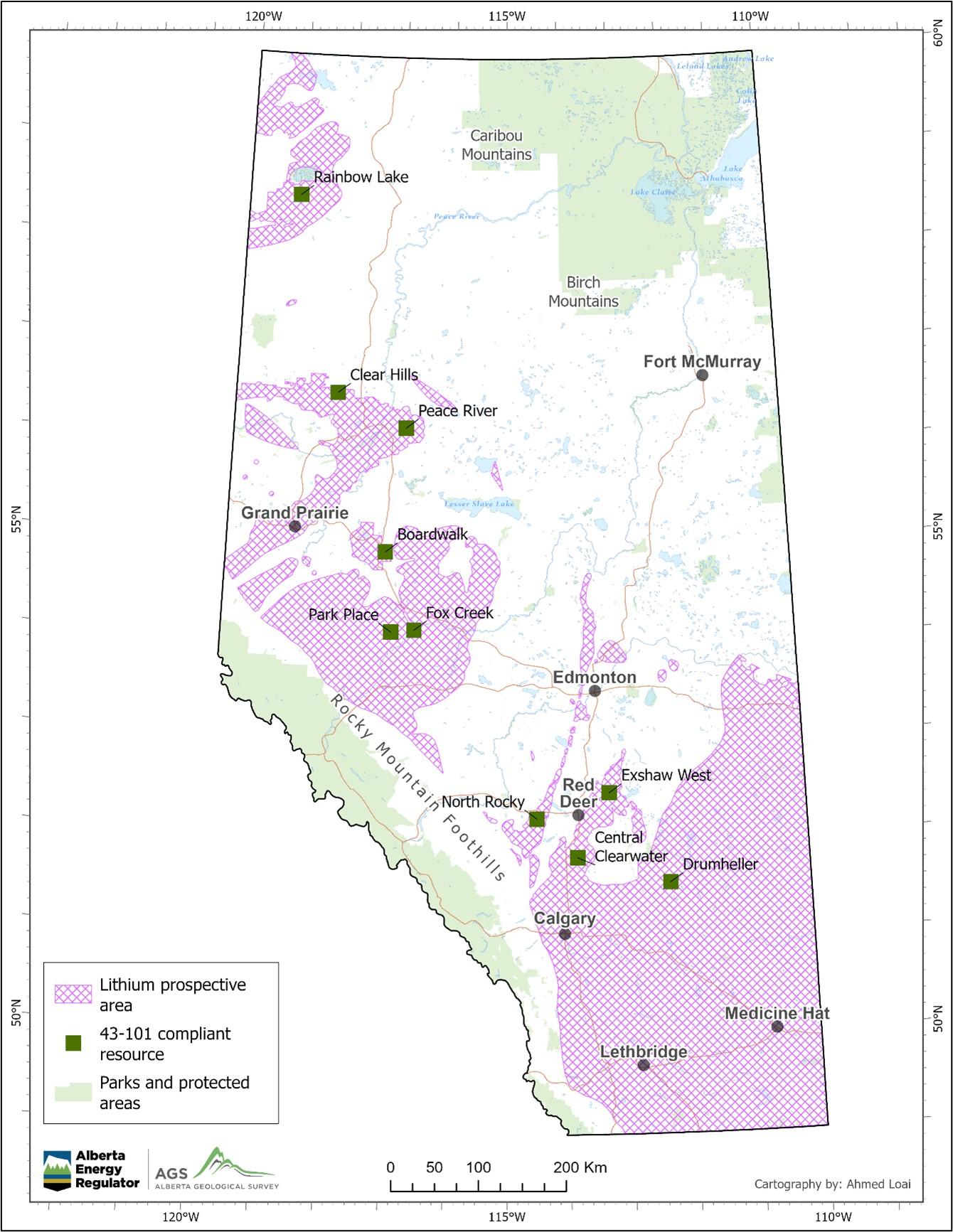

E3 Lithium operates two projects in the Bashaw district, Exshaw West and Central Clearwater between Calgary and Edmonton (see map below), oil brines of the Leduc Formation have concentrations around 75 milligrams per litre (mg/L) for an indicated and measured mineral resource estimate of 16 million tonnes of lithium carbonate equivalent (LCE)3. The Swan Hills and Leduc Formations in west-central Alberta also have brines with economic lithium concentrations (i.e., a cutoff of 50 mg/L). According to LithiumBank4, the Boardwalk project has lithium resource estimates (i.e., measured, indicated, and inferred resources) of 5.7 million tonnes of LCE, and the Park Place project has 24.5 million tonnes of LCE. The projects have a lithium grade between 79 and 82 mg/L.

In northwestern Alberta, other Devonian formations, such as the Keg River and Slave Point and the Triassic Montney Formation, require more data for a proper assessment, but have lithium brines that may be viable with improvements in extraction technology. Currently, lithium concentrations as low as 50 mg/L have been the subject of extraction technologies5).

Alberta’s lithium brines are unique because they are extracted through wells, eliminating the need for mining or extensive surface operations, unlike hard rock deposits or continental brines that require large evaporation ponds for concentration.

The map below shows brine-hosted lithium prospectivity in Alberta, including projects with resource estimates. Polygons for prospective areas are under final review and are expected to be published on the AGS website and will replace Map 590.

Limitations or Risks to the Outlook

Lithium extraction costs are expected to be lower in the future. Lithium production is expected to become competitive as new extraction methods are developed and proven scalable and processing infrastructure becomes available in the coming years. The economic feasibility of the lithium industry depends on climate change policies, technology development, financial support, and associated risks. Risks include disruptive technologies, concentrated supply chains, and potentially volatile markets. Several actions can be taken to improve lithium economics and reduce investment risks:

- Design advanced extractive technologies.

- Ensure responsible mining and environmental, social, and corporate governance standards to attract investors.

- Establish infrastructure and supply chains.

Since there is no commercial lithium production yet, there is no tariff case scenario forecast. The industry is still in the early stages of development, and tariffs are not anticipated to delay the start of commercial lithium production.

1Hitchon, B., Underschultz, J.R. and Bachu, S. (1993): Industrial mineral potential of Alberta formation waters; Alberta Research Council, Alberta Geological Survey, Open File Report 1993-15, 85 p.

2Reimert, C., Lyster, S., Palombi, D. and Bernal, N. (2025): Brine geochemical data, Mineral Mapping Program, 2023 (tabular data, tab delimited format); Alberta Energy Regulator / Alberta Geological Survey, AER/AGS Digital Data 2023-0019. Bernal N. (2025). The Origin of Lithium and Other Alkali Metals in Devonian Brines of Alberta. Open File Report (OFR), Alberta Energy Regulator / Alberta Geological Survey, (in preparation).

3E3 Lithium, 2023. 43-101 Technical Report: Lithium Resource Estimate. Bashaw District Project, Central Alberta. March 21, 2023.

4LithiumBank 2024a. NI 43-101 Technical Report & Preliminary Economic Assessment for the Boardwalk Project. February 24, 2024. LithiumBank, 2024b. Resources Corp. Park Place NI 43-101 Technical Report. June 24, 2024.

5S&P Global (2024). Direct lithium extraction from oil and gas production – An initial assessment. Nov. 2024. https://www.spglobal.com/content/dam/spglobal/ci/en/documents/products/pdf/CI_1124_Lithiumfromproducedwater.pdf?utm_source=chatgpt.com

Related Information

-

Data [XLSX]

-

Methodology

-

Resource Development Topic > Mineral Resource Development

-

AGS > Critical Minerals Potential

-

AGS > Minerals Mapping Program

-

AGS > Alberta Geology, Minerals, and Energy Infrastructure Interactive Mapping Application

-

AGS > AER/AGS Open File Report 2021-04 [PDF]

-

AGS > Brine Geochemical Data, Mineral Mapping