November 2025

Liability is estimated using calculations outlined in Directive 011 and through site-specific liability assessments (SSLAs). The estimated liability has changed over the last 20 years due to both changing operational practices and varying costs for closure work. Directive 011 determines the estimated liability for a licence based on regional costs for different scenarios and infrastructure characteristics. Site-specific estimated liabilities are determined through SSLAs.

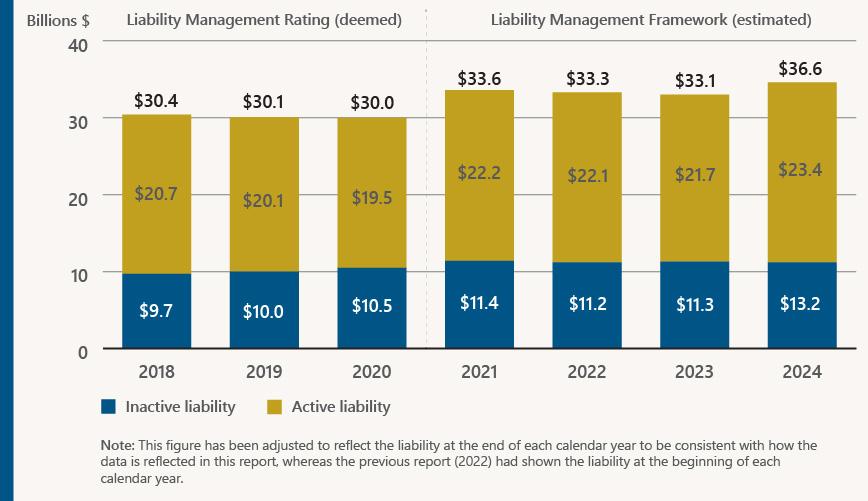

Total estimated liability includes decommissioning and reclamation liabilities associated with wells and facilities and for sites with site-specific liability assessments. Figure 8 provides the total, active, and inactive estimated liability.

Historically, “deemed” liability was the liability used for the liability management rating (LMR), and the values in figure 8 correspond with previous LMR reports. In 2020, with the introduction of the new liability management framework, the AER began reviewing and removing historical overrides to calculate the estimated liability. The increased estimated liability in 2021 was due to the inclusion of sweet multiwell batteries that had not been included previously.

It is important to understand that the actual closure cost may not match the estimated cost (or estimated liability). The actual amount spent is reported by licensees as closure spend, which we will use to inform the regional costs listed in Directive 011. The estimated liability is assigned to a well, facility, waste management or pipeline licence or approval based on Directive 011 or an associated SSLA. When a closure milestone is reached (decommissioned or reclamation certificate issued), the estimated liability is reduced by the value assigned from the most recent edition of the directive or the associated SSLA, not the amount actually spent.

Directive 011's decommissioning costs were last updated in 2015. Figure 8 presents 2018–2023 values based on the 2015 costs. The directive was revised (see Bulletin 2024-16) with updated well decommissioning costs and raising the total liability to about $36.6 billion as of June 2024. Estimated liability values will continue to improve over time as more closure spend data is collected and analyzed.

Figure 8. Estimated Liability, 2018–2024

Licensee Capability

In addition to understanding liability, it is essential to understand whether companies can meet their regulatory and liability obligations throughout the energy development life cycle. To do this, we use a holistic licensee assessment (see Directive 088 and Manual 023 for details). Two important factors this assessment considers are a licensee’s total magnitude of estimated liability and their level of financial distress.

Figure 9 outlines the number of active licensees in each category based on the magnitude of the total estimated liability and their level of financial distress. It highlights the percentage of total liability held by each group. Most of the estimated liability (82%) is held by licensees in low financial distress, whereas 5% of the total liability is held by licensees in high financial distress.

Figure 9. Licensee liability by magnitude of liability and level of financial distress

Transfers

Holistic licensee assessments are now used in various regulatory processes. Specifically, when licensees want to buy or sell assets, they must submit a licence transfer application to the AER. When transfers are reviewed by the AER, the licensees involved are assessed using numerous factors, including their level of financial distress and the amount of inactive liability included in the transfer (see Manual 023 for more information). Licensees presenting higher levels of risk are subject to greater scrutiny, which requires the collection of security. Table 1 summarizes transfer applications based on licensee capability.

Table 1. Transfer analysis by licensee capability, 2022 to 2024

| Year | Assets Transferred To | Well Count | Facility Count | Pipeline Count | Total Liability (millions) | Inactive Liability (millions) | Security Collected (millions) | % of Security Collected Related to Inactive Liability |

|---|---|---|---|---|---|---|---|---|

| 2022 | Licensee (more capability) | 1 263 | 120 | 324 | $94.70 | $41.80 | $0.14 | 0% |

| Licensee (less capability) | 197 | 38 | 36 | $16.70 | $13.70 | $1.02 | 7% | |

| New licensees | 2 489 | 268 | 332 | $189.10 | $68.90 | $5.93 | 9% | |

| 2023 | Licensee (more capability) | 4 693 | 524 | 589 | $348.90 | $130.00 | $0.07 | 0% |

| Licensee (less capability) | 459 | 90 | 162 | $62.50 | $19.40 | $0.40 | 2% | |

| New licensees | 7 003 | 619 | 925 | $576.60 | $142.30 | $25.37 | 18% | |

| 2024 | Licensee (more capability) | 1 741 | 126 | 111 | $76.70 | $23.30 | $0.20 | 1% |

| Licensee (less capability) | 1 557 | 273 | 429 | $197.50 | $73.60 | $0.50 | 1% | |

| New licensees | 2 702 | 364 | 663 | $274.30 | $118.20 | $24.70 | 12% |

Note: Licensee capability is assessed through the holistic licensee assessment, including their level of financial distress. New licensees are defined as having a new business associate (BA) code registered with the AER within the last three years. The data shown has been adjusted to reflect the transfers by application decision date, whereas the previous report had shown the liability by application date.

When licences are transferred, the amount of inactive liability collected as a security deposit depends on the financial capability of the receiving licensee:

- For financially more capable licensees, transfers typically do not result in a high percentage of inactive liability being collected as security. The receiving licensee has a low or medium financial distress level and does not fall within the highest ranges in tables 9 or 10 of Manual 023.

- For financially less capable licensees, transfers typically result in a higher percentage of inactive liability being collected as security. The receiving licensee has a medium or high financial distress and does not fall within the lowest ranges in tables 9 or 10 of Manual 023.

- For new licensees, transfers typically result in the highest percentage of inactive liability being collected as security. New licensees do not have an established history with the AER and are considered a higher risk until we have more information on their capabilities and performance.

In 2024, most transfers were from existing licensees to new licensees ($274 million in estimated liability transferred to new licensees). As a result of these transfers, 21% of the inactive liability value was collected via security.