Updated June 2025

Within this section

Highlights of 2024

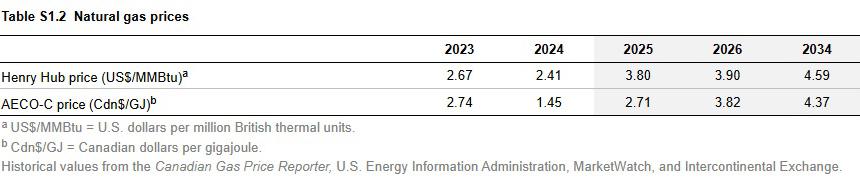

Henry Hub: The primary price benchmark for U.S. natural gas decreased by 9.7% in 2024, averaging US$2.41 per million British thermal units (MMBtu). The Henry Hub price decrease was attributed to elevated North American inventories and mild winter weather, reducing residential and commercial natural gas demand.

AECO-C: The AECO-C price, the benchmark for Western Canadian natural gas, decreased 47% from 2023 to an average of Cdn$1.45 per gigajoule (GJ) in 2024. The price decrease was primarily attributed to regional oversupply and warmer-than-expected winter weather, leading to a significant excess inventory.

Price differential: The price differential between Henry Hub and AECO-C widened to $1.29/MMBtu in 2024, up from US$0.52/MMBtu in 2023.

Table S1.2 shows the historical and forecast prices for natural gas.

Highlights for 2025 to 2034 – Short-Term Uncertainty Scenario (Base Case)

Despite the U.S. tariff uncertainty, North American natural gas prices are expected to rebound in 2025 from relatively low levels experienced in 2024. This increase is driven by colder winter weather, low North American inventories, and LNG capacity expansions in both the U.S. and Canada.

Henry Hub: The Henry Hub price is forecast to rise to US$3.80/MMBtu in 2025, reaching US$4.59/MMBtu by 2034. Long-term demand is anticipated to increase, primarily driven by growth in U.S. domestic demand and exports.

AECO-C: The AECO-C price is forecast to increase to Cdn$2.71/GJ in 2025 and reach Cdn$4.37/GJ by 2034.

Price differential: The price differential between AECO-C and Henry Hub reflects transportation costs, regional supply and demand balances, and infrastructure constraints. The AECO-C and Henry Hub price differential is anticipated to average around US$1.80/MMBtu in 2025 and narrow to US$1.00/MMBtu in 2026, remaining steady for the remainder of the forecast period.

Highlights for 2025 to 2034 – One-Year Tariff Scenario (Tariff Case)

Despite diplomatic efforts, Canada is unable to avoid the U.S. tariffs. We have assumed a 10% tariff on Canadian energy products and a 25% tariff on other goods starting in the first half of 2025. The U.S. has implemented additional tariffs on China, the European Union, and other major trading partners. Canada and other U.S. trading partners will respond with tariffs on the U.S. Under this scenario, the tariffs between Canada and the U.S. are assumed to remain in place for 12 months before mostly being phased out in 2026. All other natural gas supply and demand assumptions are unchanged compared with the base case price forecast.

Henry Hub: The Henry Hub price under the tariff case is forecast to rise to US$3.20/MMBtu in 2025, reaching US$4.37/MMBtu by 2034.

AECO-C: The AECO-C price under the tariff case is forecast to increase to Cdn$1.56/GJ in 2025, reaching Cdn$4.09/GJ by 2034.

Price differential: The AECO-C and Henry Hub price differential is anticipated to widen under the tariff case to US$2.10/MMBtu in 2025. As tariffs ease in 2026, the differential is expected to narrow to US$1.20/MMBtu in 2026 and stabilize at US$1.00/MMBtu over the remaining forecast period.