Updated June 2025

Summary

The number of new wells placed on production increased by 23% in 2024. Despite a slight drop in oil prices, mature basins, and elevated costs, well activity increased, most notably in Petroleum Services Association of Canada (PSAC) areas 4 and 7. Lower interest rates and improved drilling efficiency supported continued drilling in highly productive formations. Over the base case forecast period, the number of new wells placed on production will hover above 3000 per year. However, continued capital discipline paired with inflationary pressures are expected to constrain future drilling activity. The decline in drilling is mild and gradual over the forecast period and stabilizes by 2034, with new well counts expected to remain well above 2023 levels.

Figure S4.4 shows the average daily production of crude oil and the number of new wells placed on production.

Well Activity in 2024

In 2024, 3385 new crude oil wells were placed on production compared with 2760 in 2023. Despite slightly lower commodity prices and inflated capital and operating costs, prices remained well above 2021 levels supporting drilling activity through 2024. Lower interest rates and access to high-productivity formations (the Cardium and Montney Formations and the Mannville Group) were the primary factors supporting drilling. In 2024, the new wells placed on production comprised

- 15 vertical wells (less than 1% and a 52% decrease from 2023) and

- 3370 horizontal wells (more than 99% and a 23% increase from 2023).

Table S4.1 shows the crude oil production and wells placed on production in 2023 and 2024 and includes the base case forecast to 2034.

Producers continued disciplined capital spending, focussing on economic new drilling and reducing debt in 2024. New well investments either targeted high-value light-density crude oil or ultra-heavy crude oil formations requiring lower drilling capital costs.

Despite inflationary pressures, cost reductions continued through advancements in drilling and completion, allowing some producers to drill longer wells in less time at a lower cost per metre. For horizontal wells using hydraulic multistage fracturing, the increased fracturing stages per well and multiple lateral legs resulted in higher production and slower decline rates.

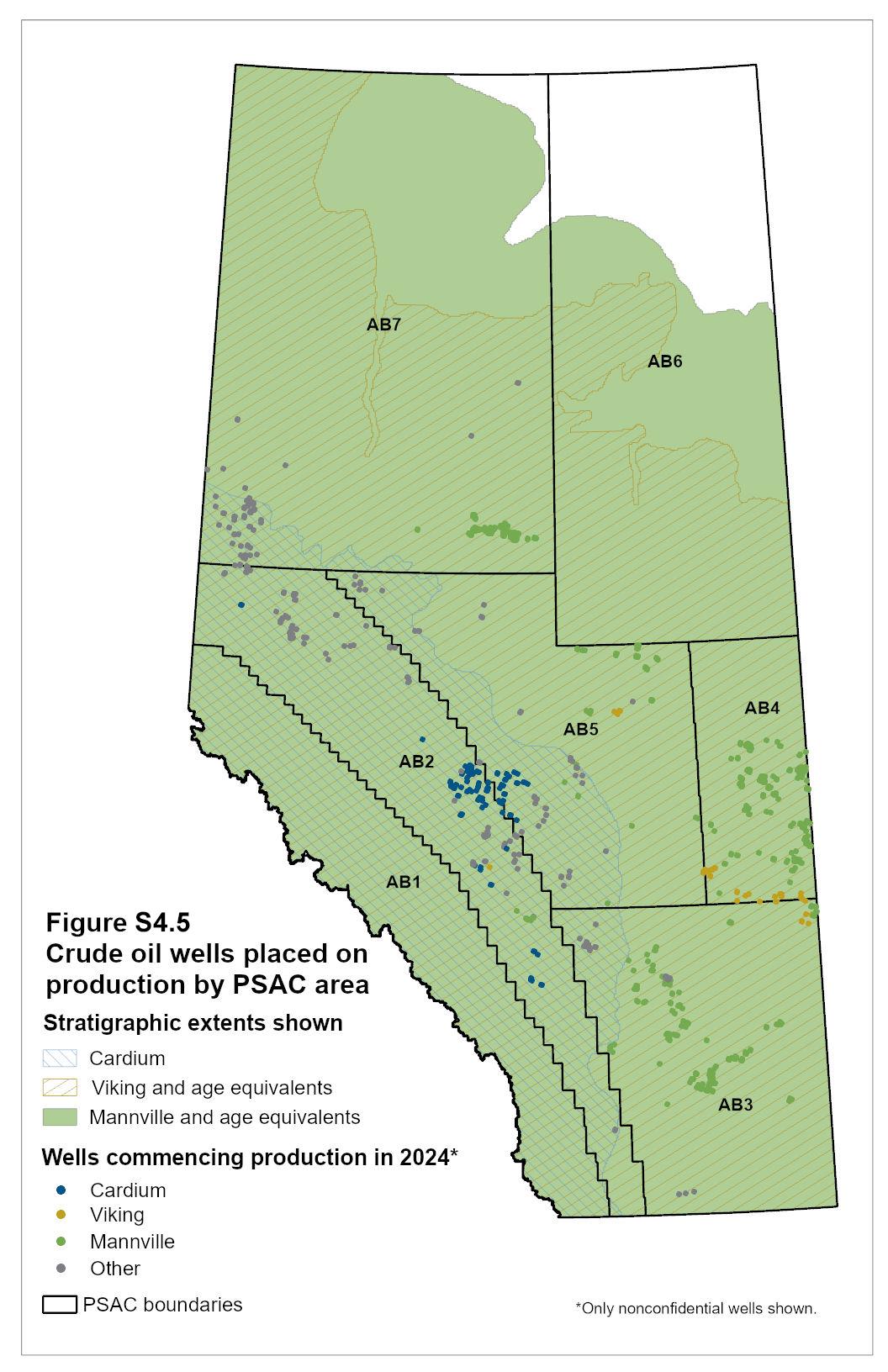

Figure S4.5 shows the wells placed on production in 2024 by PSAC area and their distribution in the Cardium Formation, Viking Formation, and Mannville Group.

Base Case Forecast for 2025 to 2034

Between 2025 and 2034, the average number of new oil wells placed on production is expected to be around 3100 per year. However, in the near term, more favourable prices will result in better profit margins and slightly higher well activity. Producers will continue targeting light crude oil and ultra-heavy crude oil formations with better economic returns. Drilling activity is expected to remain robust in PSAC 4 and 7.

Figure S4.6 shows the historical trend between average daily production and the number of wells producing crude oil in Alberta.

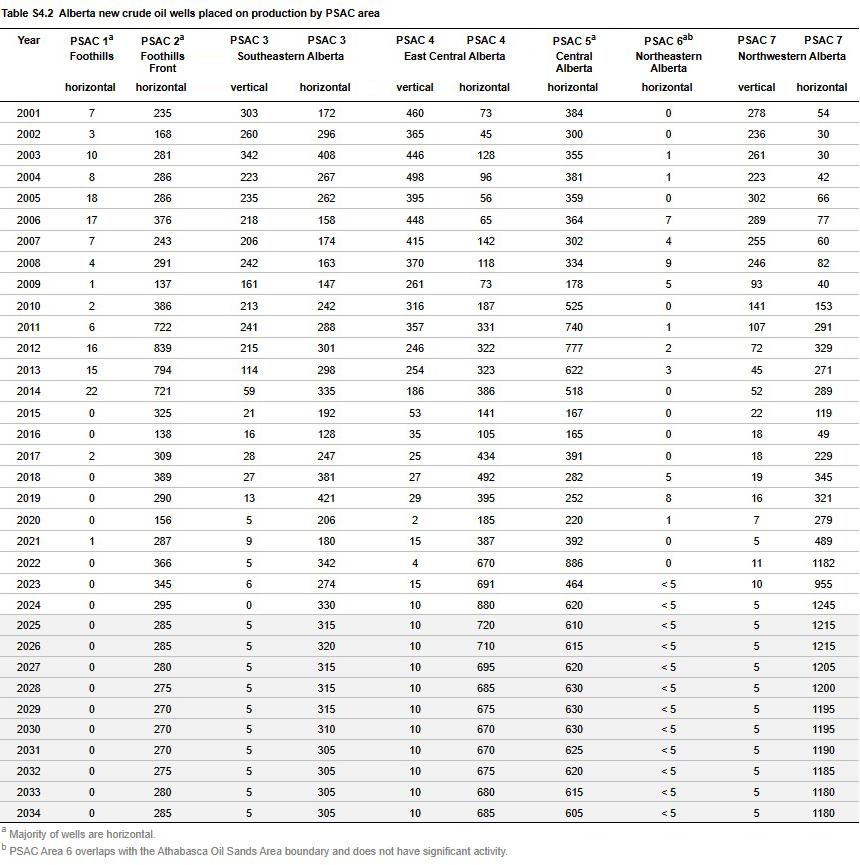

Table S4.2 shows the number of new crude oil wells placed on production by PSAC area and includes the base case forecast to 2034.

One-Year Tariff Scenario (Tariff Case)

The tariff case projects fewer new wells placed on production across the forecast period. As tariffs reduce prices, increase costs, and erode Alberta’s comparative advantage, the number of new wells drilled is expected to fall below the base case despite a similar forecast trajectory.

An estimated 2835 new wells will be drilled in 2025, a 10% reduction from the base case. Throughout the forecast period, new wells drilled will remain stable above 2023 levels settling around 2950 per year, averaging 6% below the base case. New wells drilled do not rebound to base case levels due to foregone investment early in the forecast and lower oil prices inhibiting new drilling rates and profitability over the forecast period.

Figure S4.7 shows the number of new crude oil wells placed on production in both the base case and tariff case forecasts.