Updated June 2025

The supply cost of a resource project is the minimum constant dollar price needed to recover all capital expenditures, operating costs, royalties, taxes, and earn a specified return on investment. Supply costs indicate whether a project is economically viable.

The most effective and cost-efficient completion technology used depends on the underlying geology. Supply costs vary significantly for different geological plays and the Petroleum Services Association of Canada (PSAC) areas because of

- differing production rates,

- well types,

- drilling and operating costs, and

- royalties.

Wells with a longer total measured depth, typically horizontal wells, tend to have higher initial productivity, but also higher capital costs. However, the higher initial productivity of these wells will usually offset the higher capital costs, resulting in lower supply costs.

Wells drilled in the following PSAC areas tend to be horizontal and have higher initial productivity:

- Foothills Front (PSAC 2)

- Central Alberta (PSAC 5)

- Northwestern Alberta (PSAC 7)

Supply Costs by PSAC Area

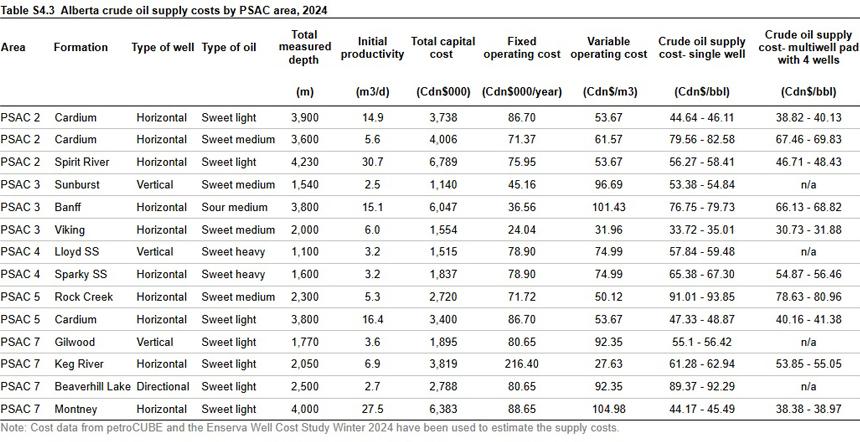

Table S4.3 shows the estimated supply costs for crude oil by PSAC area. These costs are based on 2024 capital and operating costs and representative production profiles. Companies often drill more than one well or lateral leg from a well pad (commonly referred to as a multiwell pad or multilateral well). These wells take advantage of economies of scale and typically incur lower capital costs, resulting in a lower cost per unit of output.

Supply costs in 2024 increased by an average of 6% from 2023 due to lower initial productivity rates in PSAC areas 2, 4, 5, and 7 and increased capital and operating costs. Estimated drilling, casing, and completion costs increased across all PSAC areas. Higher associated drilling costs, such as service rigs, labour, production casing and cementing, completion fluids, fracture stimulation, transportation, and equipment rentals, also contributed to higher supply costs.

One-Year Tariff Scenario (Tariff Case)

Due to the addition of a tariff scenario to this year’s publication, supply costs for single wells and multi well pads contain an upper and lower cost estimate in Table S4.3. The lower bound represents the base case cost estimate and the upper bound represents the tariff case cost estimate. Tariffs are assumed to last for one year, increasing the costs of key inputs related to oil and gas drilling and production.