Updated June 2025

Figure S3.3 shows the average daily production of raw bitumen in Alberta from in situ projects and surface mining.

In 2024

In situ bitumen production increased by 4.2% to 292.0 thousand cubic metres per day (103 m3/d) or 1837.3 thousand barrels per day (103 bbl/d). In situ bitumen production accounted for 52% of total raw bitumen production.

In situ production increases occurred across all recovery methods. As shown in Table S3.2, two out of three oil sands areas contributed to the production growth. In situ production increases in 2024 were primarily attributable to growth in the Athabasca region.

Production in the Cold Lake region increased significantly from record production levels by a few projects during the year.

Highlights

Production data by project are reported in the ST53: Alberta In Situ Oil Sands Production Summary. The following are the 2024 highlights for in situ bitumen production:

- In situ production continued to grow in 2024 with favourable oil prices.

- With investment focused on expanding existing sites rather than new projects, multiple in situ operations hit record production levels as productivity increased due to targeted facility enhancements, optimization of operations, and debottlenecking.

- Activity rose in the Athabasca region, where most in situ bitumen production occurs. Suncor’s Firebag project added over 16 000 bbl/d of production following optimization of its operations.

- The Cenovus Foster Creek project also had record annual production levels, adding over 10 000 bbl/d as production from new well pads continued to ramp up.

- Production was up in the Cold Lake region, driven by the Imperial Cold Lake project. The increase was supported by production from the Imperial Grand Rapids project, which deployed the solvent-assisted steam-assisted gravity drainage (SA-SAGD) technology commercially with lower emissions.

- Primary bitumen production advanced considerably in the Peace River region as companies, such as Baytex Energy, increased production.

Base Case Forecast for 2025 to 2034

A list of proposed projects considered in the forecast is included in the methodology section.

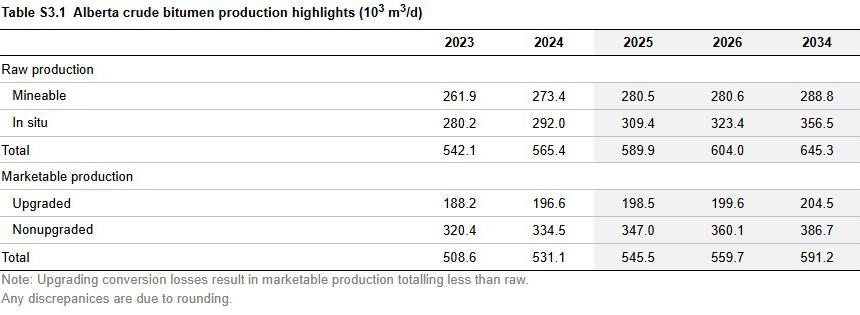

In situ bitumen production volumes in the base case are expected to grow in the near term, in line with oil price forecasts (Table S3.1). By 2034, in situ bitumen output is forecast to be 356.5 103 m3/d (2243.3 103 bbl/d), representing an average annual growth of about 2.0%.

Projected production growth is based on favourable market conditions, producers optimizing operations, and expanding their existing facilities from current projects.

In situ production will continue to drive the forecast bitumen production growth, supported by pipeline capacity expansion or unused capacity from the Trans Mountain expansion. Takeaway capacity on the province’s pipeline infrastructure is forecast to improve in the next few years, including Enbridge’s potential expansion of its Mainline pipeline and storage assets. Growth later in the forecast is supported primarily by operational optimization projects, improved market access, higher oil prices.

Based on 2024 crude bitumen supply costs estimates, in situ expansions are considered a more economical option compared to greenfield in situ or mining projects. This trend indicates that most new bitumen production will likely come from expansion projects and debottlenecking efforts rather than large-scale, new project developments, as they enable increased production at lower costs by optimizing existing infrastructure.

One-Year Tariff Scenario (Tariff Case)

In this scenario, one-year tariffs on oil and gas exports and other sectors impact investment decisions on in situ bitumen production causing delayed project expansions, limiting the pace of capacity and production growth. Although the overall trajectory remains similar to the base case, in situ production is expected to be lower considering heightened uncertainty, supply chain disruptions, and a broader economic slowdown.

In 2025, in situ bitumen production in the tariff case is expected to be 302.0 103 m3/d (1900.7 103 bbl/d), 2.4% lower than the base case. In 2027, the in situ production will reach 319.4 103 m3/d (2009.7 103 bbl/d), 5.5% lower than the base case as the tariff impacts linger. Thereafter, the production is expected to increase at a faster pace. In 2034, in situ bitumen production is expected to reach 346.6 103 m3/d (2181.2 103 bbl/d) 2.8% lower than the base case.

Figure S3.5 shows the comparison between the base case and the tariff case.