Updated June 2025

What is Hydrogen

Hydrogen is an energy carrier and one of the most abundant elements on Earth. Hydrogen is a colourless, odourless, and flammable gas found almost everywhere on Earth but only bonded with other elements, such as carbon, nitrogen, and oxygen.

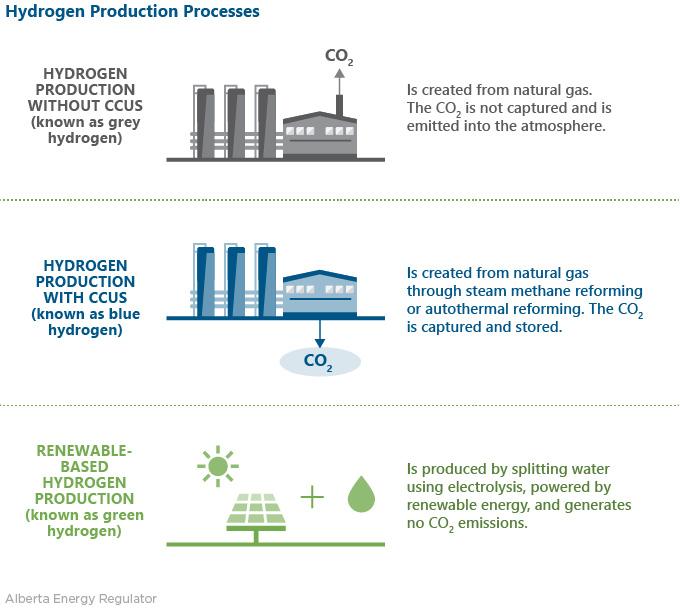

Hydrogen can be produced from a variety of sources using different technologies. Some common sources include natural gas and water. In Alberta, hydrogen production is mainly produced from natural gas. This is typically achieved through steam methane reforming or autothermal reforming methods. These methods introduce high-temperature steam and a catalyst to methane, producing hydrogen, carbon monoxide, and carbon dioxide (CO2). With additional processing, carbon monoxide is converted to CO2. The figure below shows hydrogen production pathways and their by-products.

There is an opportunity for hydrogen to replace fossil fuels as a carbon-free energy source. Hydrogen-powered electric vehicles have zero emissions, whereas gasoline vehicles emit carbon monoxide, CO2, hydrocarbons, and nitrogen oxides.

The refining and industrial sectors drive global hydrogen demand. However, demand for hydrogen is expected to expand to other industry sectors, such as transportation, power generation, and heating. In parallel with the growth in hydrogen demand, uses for CO2 captured from hydrogen production with carbon capture, utilization, and storage (CCUS) continue to develop.

Federal and Provincial Government Hydrogen Plan

The federal government has set a hydrogen strategy for Canada, leading to actions that will establish hydrogen production to achieve Canada's goal of net-zero emissions and be a leader in clean and renewable fuels by 2050. The near-term demand for hydrogen will be influenced by the market readiness of applications and commercial applications (e.g., heavy-duty trucks, power generation, industrial feedstock, and heat for industrial sites).

Alberta developed a hydrogen road map to enable large-scale production of low-cost and low-carbon intensity hydrogen. The Alberta Industrial Heartland region near Edmonton has the advantage of becoming one of the first hydrogen-producing hubs in Canada. It has access to plentiful natural gas sites, potential CCUS sites, and an existing hydrogen pipeline. Leveraging the existing infrastructure will reduce the upfront production costs of new hydrogen projects. Other Alberta advantages include experience and technical capacity in producing, handling, and using hydrogen at the industrial scale, positioning the province as the largest hydrogen producer in Canada today. Alberta has the necessary skilled workforce that pioneered the Canadian energy industry and is poised to support the emerging clean hydrogen economy.

As global energy policies shift, particularly in the U.S., where key initiatives such as the Paris Agreement withdrawal and halted hydrogen funding under the Inflation Reduction Act have signalled declining support-Canada and Alberta have a unique opportunity to incentivize greater hydrogen investment.

Production in 2024 and Base Case Forecast

In 2024, hydrogen production without CCUS was estimated to be 2.1 million tonnes, while hydrogen production with CCUS reached 0.5 million tonnes. The hydrogen production base case forecast involves weighing the risks based on the likelihood of meeting the project’s operational date and production capacity.

Figure S9.1 shows the forecast for hydrogen production in Alberta.

Current uses of hydrogen in Alberta include industrial applications, such as chemical production, oil refining, bitumen upgrading, and nitrogen-based fertilizer production. ATCO is blending hydrogen with natural gas for residential heating systems in the Fort Saskatchewan area. Other potential uses through pilot projects are for transportation, including hydrogen fuel-cell vehicles (cars, buses, trucks) and hydrogen co-combustion engines primarily for heavy-duty applications.

Projects

Several companies have announced hydrogen projects in Alberta:

- Air Products’ first hydrogen liquefaction facility with CCUS in Western Canada is planned to begin commercial production in 2025, with plans to produce up to 1500 tonnes of hydrogen per day.

- Pembina Pipeline and Marubeni Corporation plan to build a low-carbon ammonia and hydrogen plant near Fort Saskatchewan. The facility will produce one million tons of blue ammonia annually for export to Asia.

- Linde is investing over $2 billion to build and operate a world-scale integrated clean hydrogen and atmospheric gases facility in Alberta. The facility will supply clean hydrogen to Dow’s Path2Zero project and other industrial customers.

- Suncor and ATCO announced they are jointly building a production facility for clean hydrogen in the Alberta Industrial Heartland region. The project, awaiting investment decision this year, is expected to produce about 300 000 tonnes of hydrogen per year.

- Hydrogen Canada Corp. (HCC) plans to build a blue hydrogen and ammonia facility in Alberta for export to Asia. The project, expected to begin operation in 2028, will produce up to 500 tonnes of hydrogen per day when fully operational.

Several pilot projects across the province are exploring new deployment applications and methods of cost-effective clean hydrogen production:

- Ekona Power received a $79 million equity investment to commercialize its low-cost clean hydrogen production technology.

- The Invest Alberta Corporation, Alberta Transportation, and the Canadian Infrastructure Bank have signed a memorandum of understanding to build a Calgary to Banff hydrogen-powered rail passenger project. The project is currently under design.

- ATCO and Qualico are conducting a feasibility study funded by the Alberta Hydrogen Centre of Excellence to develop a hundred per cent pure hydrogen community in Strathcona County.

One-Year Tariff Scenario (Tariff Case)

The potential of U.S. tariffs on Canadian goods is expected to create short-term market disruptions and investment uncertainty.

Despite the short-term challenges that U.S. tariffs may impose, key hydrogen projects are expected to continue advancing. Air Products' hydrogen facility is planned to begin production this year. The facility has secured a contract to supply hydrogen to Imperial Oil's new renewable diesel plant, which is scheduled to start operation this year and support the supply of low-carbon fuels for British Columbia’s transportation sector. Although, Dow has announced a delay to its Path2Zero project, the company remains committed to its long-term execution. Furthermore, Alberta currently does not export any hydrogen internationally. These developments indicate that tariffs may cause minimal disruptions to the long-term outlook for hydrogen production.

Overall, hydrogen production under the tariff case is expected to decline slightly to 3.0 million tonnes in 2025 compared with the base case forecast of 3.1 million tonnes. As tariffs are removed in 2026, production is projected to increase over the forecast period. It is estimated to reach 4.2 million tonnes by 2034, 4% below the base case forecast.

Figure S9.2 shows the hydrogen production base case and tariff case forecasts.

Limitations or Risks to the Outlook

Future construction costs for hydrogen facilities with CCUS are expected to be lower. Hydrogen production is expected to become competitive as carbon taxes increase in the coming years. The economics of the hydrogen industry depend on climate change policies and government support. These dependencies and current high investment costs would probably affect short-term investment decisions.

As we navigate the evolving landscape, continued attention to regulatory frameworks and technological advancement will be critical in shaping the trajectory of the hydrogen industry in Alberta.