Updated June 2025

The supply cost of a resource project is the minimum constant dollar price needed to recover all capital expenditures, operating costs, royalties, and taxes and earn a specified return on investment. The supply cost indicates whether a project is economically viable.

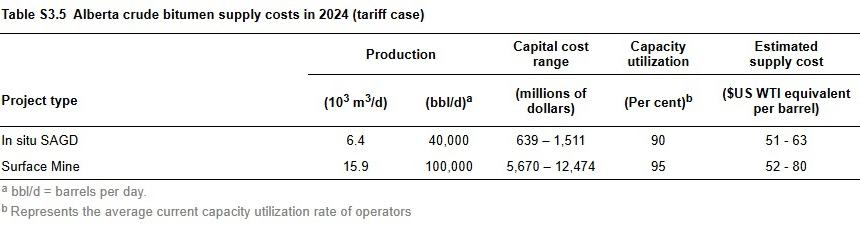

In Situ: Supply costs for in situ projects range from around US$47 per barrel (/bbl) for expansion projects to US$58/bbl for greenfield projects in the base case. Brownfield expansion projects tend to be more profitable than greenfield projects due to lower supply costs.

Mining: Supply costs for mining projects range from US$50/bbl to US$78/bbl in the base case. Similar to in situ brownfield expansions, mining brownfield expansions have lower supply costs than greenfield surface mines due to the ability to leverage existing infrastructure, reducing both capital and operating expenses.

Table S3.4 shows 2023 supply costs in the base case with a selection of key assumptions, such as capital costs, project capacities, and utilization rates.

Input cost data are based on 2024 Canadian dollars, whereas the resultant supply costs per barrel are converted to U.S. dollars to compare with the West Texas Intermediate (WTI) benchmark.

The supply cost estimates for 2024 assume that oil sands projects adhere to the Technology Innovation and Emissions Reduction Regulation (TIER) to meet facility emission benchmarks. Facilities that do not directly meet their benchmark can also comply by submitting offsets, performance credits, or payment into the TIER fund. These carbon costs are factored into the supply cost estimates for in situ and mining projects.

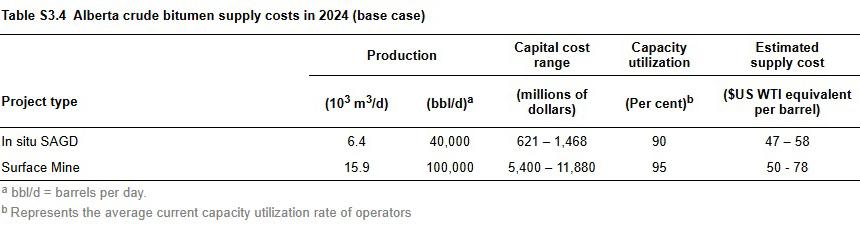

One-Year Tariff Scenario (Tariff Case)

In the tariff case, with wider oil price differentials and higher capital and operational costs, supply costs for brownfield expansion projects are estimated to be 8.5% higher, relative to the base case for in situ and 4.0% higher compared to mining operations.

Table S3.5 shows 2024 crude bitumen supply costs for the tariff case.