Updated June 2025

What is Helium

Helium is a naturally occurring colourless and odourless inert gas produced by the decay of uranium and thorium within the Earth’s mantle and crust. It is a non-renewable resource that cannot be manufactured.

Helium can be found in oil and gas reservoirs. While helium can be extracted from the atmosphere, the process is expensive. However, when helium is trapped in the subsurface, it can accumulate in underground reservoirs, making it more cost-effective to extract. Helium is generally found in low concentrations (below 0.1%), and its extraction can be profitable when concentrations exceed 0.3%. However, project feasibility depends on the processing cost, the helium price, and market proximity.

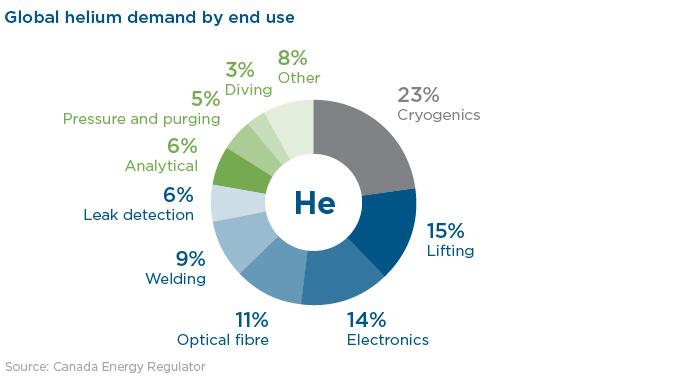

Helium has many uses, including magnetic resonance imaging (cryogenics), lifting (use in balloons), electronics, optical fibre, welding, leak detection, and more (see image below). There are many applications where helium cannot be substituted, indicating a strong and stable demand over the coming years.

The depletion of helium reserves in the mid-continental U.S. region raises concerns about domestic supply. Because helium being an indispensable resource in various critical industries, it highlights the need for strategic resource management and exploration in Alberta.

Royalty Program and Alberta's Advantages

The helium royalty is regulated under the Natural Gas Royalty Regulation. In May 2020, the Ministry of Energy and Minerals introduced a 4.25% royalty rate for helium. Hence, operators producing helium are required to report monthly production volumes and monthly average selling prices.

Alberta has several competitive advantages in becoming a key supplier of helium. These advantages include the province’s helium reserves located where oil and gas drilling has occurred, easy access to the U.S. (the world’s largest consumer of helium), well-positioned infrastructure, and industry expertise. Current development activity for helium is focused on the southern part of the province.

Production in 2024 and Base Case Forecast

In 2024, helium production was 2.2 thousand cubic metres per day (103 m3/d) from six producing wells (see Figure S9.4). Under the base case, production is forecast to reach 10.4 103 m3/d from 17 wells by 2034. The production and well forecasts involve weighing the risks based on the likelihood of meeting the project’s operational date and production capacity.

Projects

- Thor Resources, Weil Group, and Royal Helium’s Steveville purification facility were the source of helium production in 2024.

- First Helium, Global Helium, Avanti Helium Corp are currently conducting tests for developing helium projects in Alberta, with wells expected to be placed on production in the coming years.

Alberta Resource Potential

Helium can be produced as a by-product of natural gas. Alberta is one of the leading natural gas producers in Canada; the province is in a great position to become a major helium producer.

- Alberta’s helium resource potential comes from profitable helium concentrations in west-central and southern Alberta.

- Exploration and development of helium in the subsurface leverages the knowledge, expertise, and infrastructure available for oil and gas in Alberta.

- The proximity to the U.S. adds to Alberta’s potential to fill in the supply issues caused by the depletion of U.S. helium resources.

One-Year Tariff Scenario (Tariff Case)

The implementation of tariffs on Canadian products is expected to reduce investments and development in Alberta’s helium projects. Tariffs could lead to increased costs and reduced competitiveness for Alberta producers. Consequently, there would be an increased uncertainty in investment decisions in the coming years with producers deferring projects until the tariffs ease. Under the tariff case, helium production is expected to reach 9.8 103 m3/d in 2034, 6.5% below the base case forecast.

Figure S9.5 shows the helium production base case and tariff case forecasts.

Limitations or Risks to the Outlook

- Helium producers have fewer tax incentives than other mineral explorers to mitigate upfront exploration and production costs.

- Many economic areas for helium development are also suitable for carbon storage, limiting the availability of land leasing and mineral tenure rights for helium production.

Alberta’s helium industry's progress may be hindered if the current high demand diminishes. Alberta has the opportunity to develop a sustainable helium supply, ensuring reliable delivery across various sectors.