Updated June 2025

Oil Pipelines

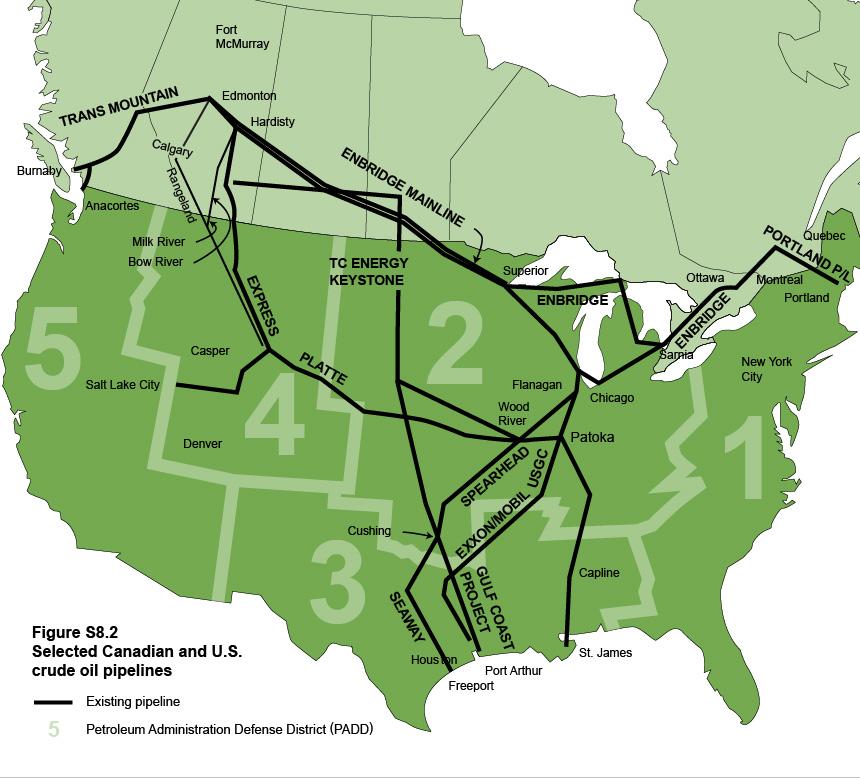

Alberta is serviced by major export lines that provide the bulk of export capacity leaving the province (see Figure S8.2).

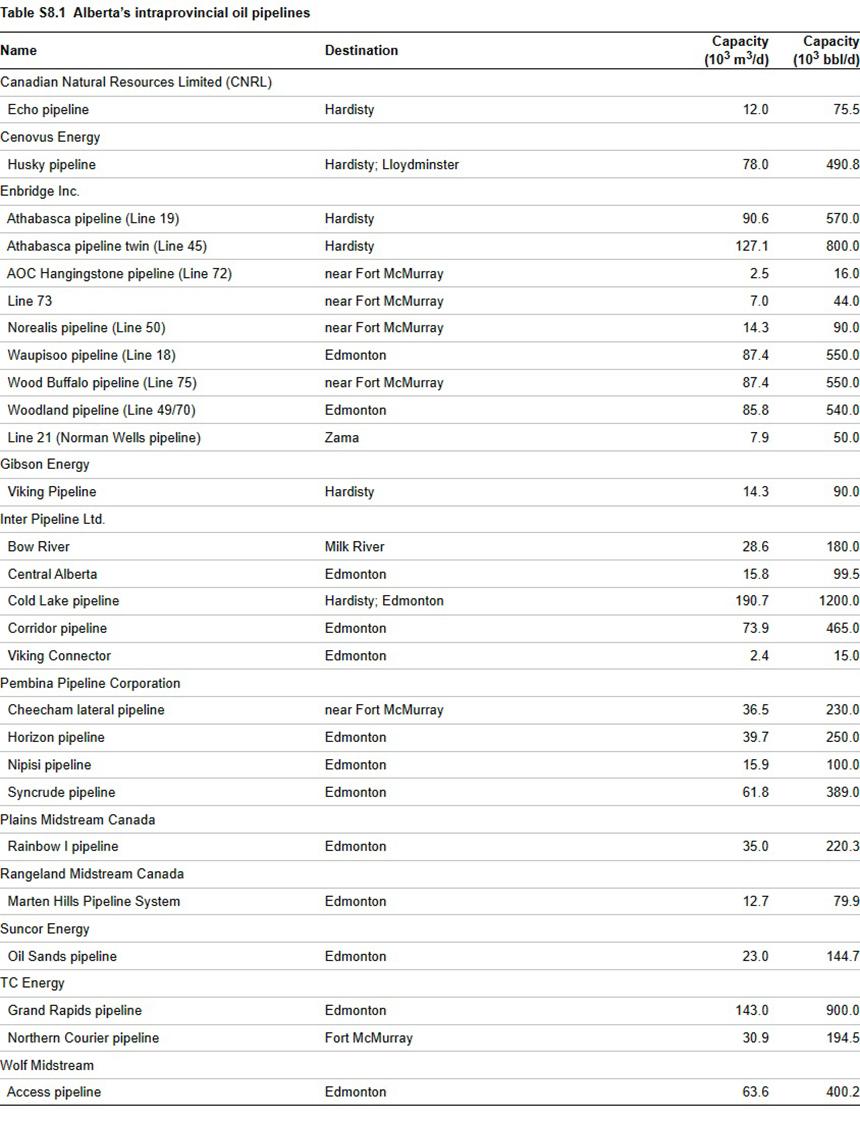

Alberta has many intraprovincial pipelines as listed in Table S8.1.

Market Access

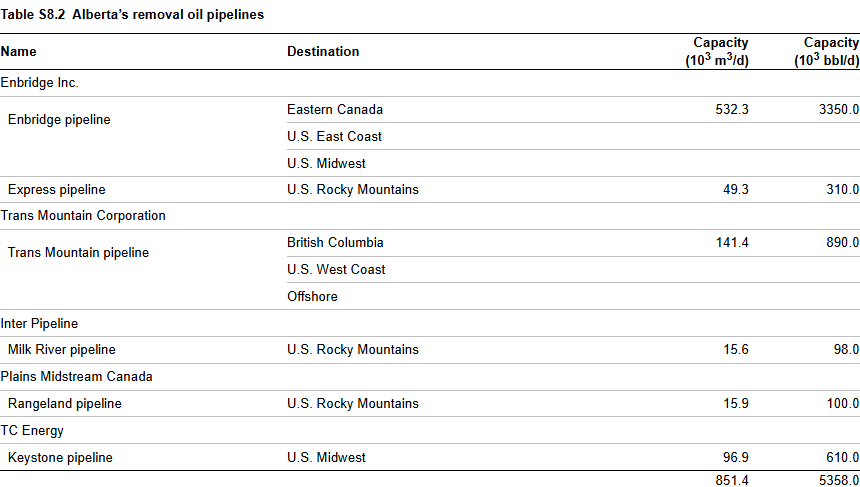

In 2024, the total pipeline design capacity to move oil from the Western Canadian Sedimentary Basin to outside markets was 851.4 thousand cubic metres per day (103 m3/d) or 5358 thousand barrels per day (103 bbl/d). Table S8.2 lists the existing pipelines that transport oil from Alberta and their destinations and design capacities.

In 2024, there was an average of 796 103 m3/d (4666 103 bbl/d) of pipeline export capacity for oil from the Western Canadian Sedimentary Basin (Figure S8.3). This amount reflects the available capacity. The Trans Mountain pipeline expansion started up in May 2024, increasing the design capacity from 300 103 bbl/d to 890 103 bbl/d.

North American Pipeline Projects

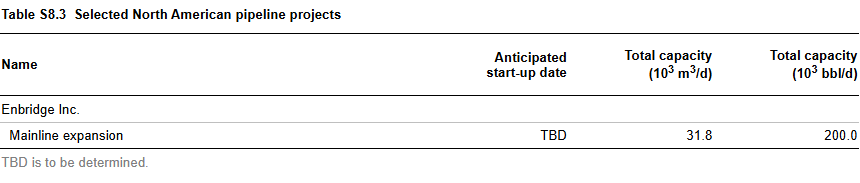

Table S8.3 lists selected proposed pipeline projects in North America and their anticipated start-up dates and capacities.

Natural Gas Pipelines

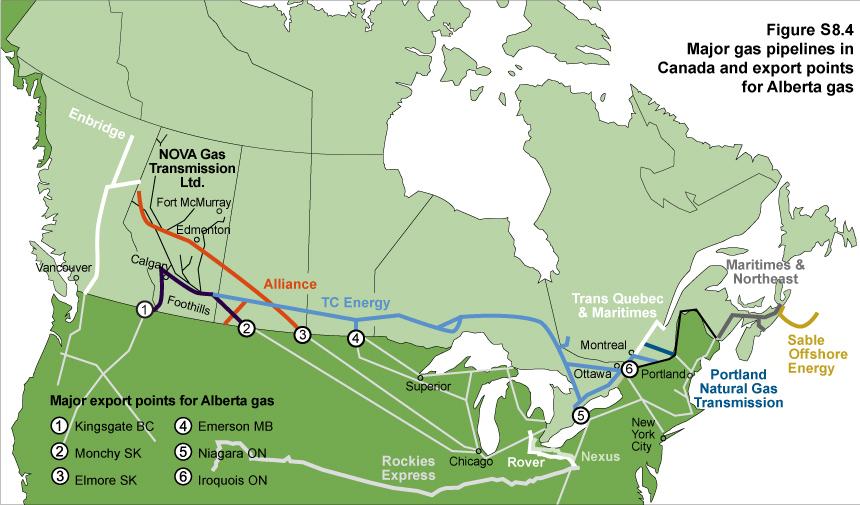

Figure S8.4 shows the major gas pipeline systems in Canada and major export points for Alberta’s natural gas.

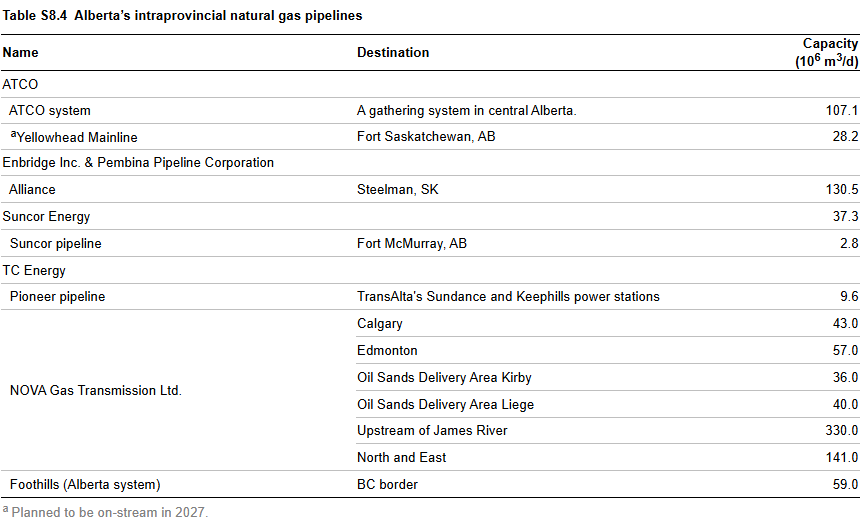

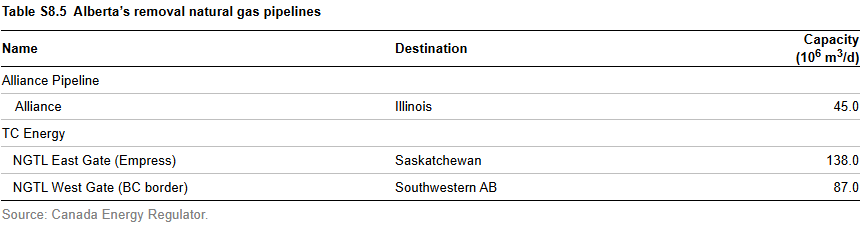

Tables S8.4 lists Alberta’s intraprovincial pipelines, and Table 8.5 lists the removal and import pipelines.

Natural Gas Liquid Pipelines

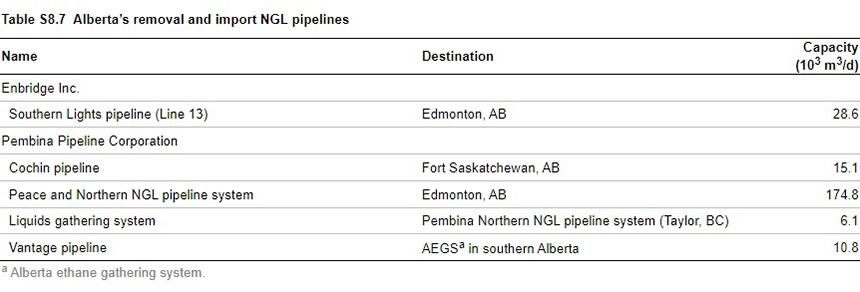

Alberta has many pipelines transporting natural gas liquids, including ethane, butane, and condensate. Since 2004, demand for condensate has exceeded Alberta’s supply because condensate is a common diluent for oil sands bitumen. Alberta now relies on imports of condensate to meet demand. Condensate imported from the U.S. is primarily through the Southern Lights pipeline (from Manhattan, Illinois, to Edmonton, Alberta) and the Cochin pipeline (from Kankakee, Illinois, to Fort Saskatchewan, Alberta). Alberta’s diluent demand is expected to increase with growing oil sands production.

Ethane Gathering and Delivery Systems

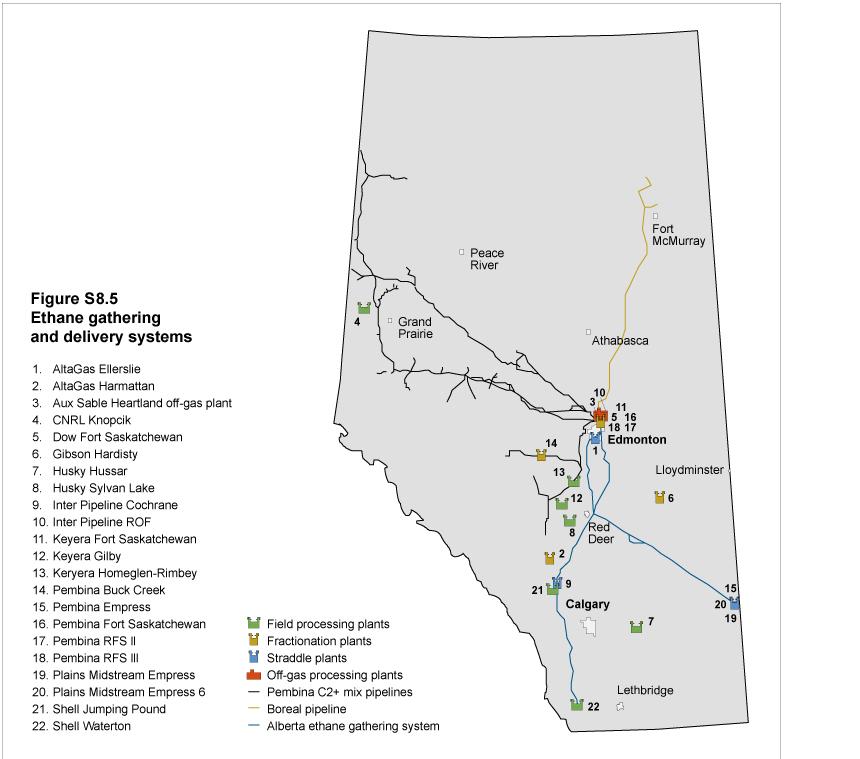

Figure S8.5 shows the ethane gathering and delivery systems in Alberta.

Natural Gas Liquids Pipeline Capacity

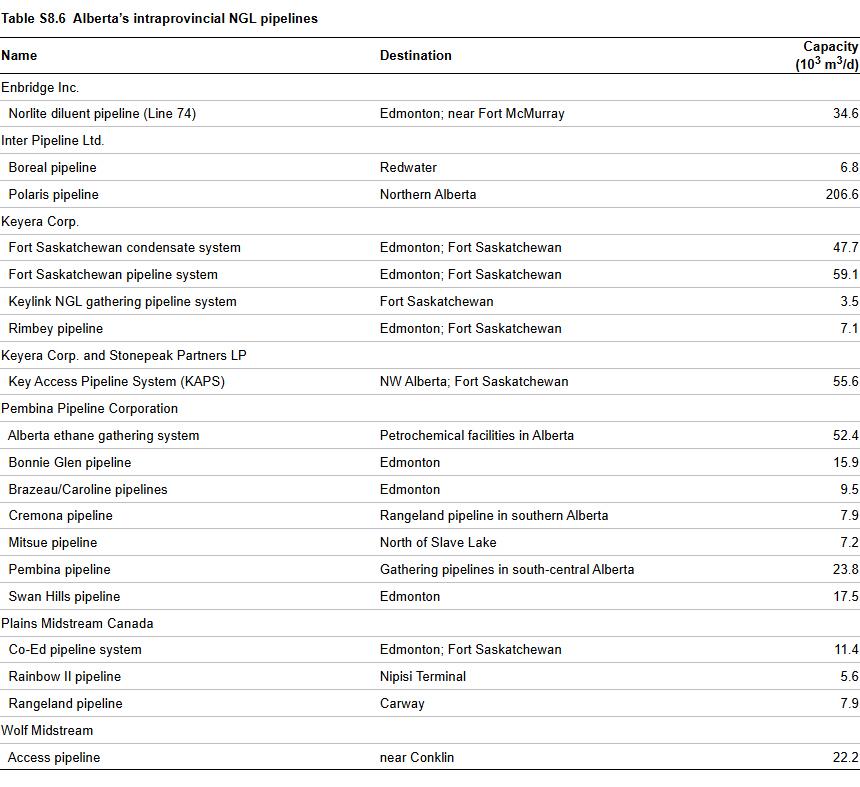

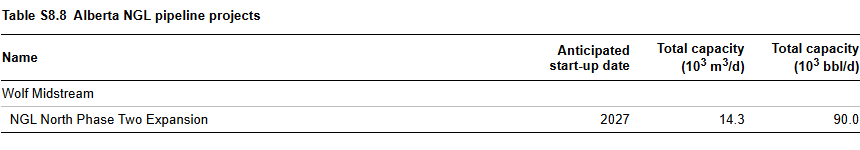

Table S8.6 lists Alberta’s intraprovincial natural gas liquids (NGLs) pipelines, Table S8.7 lists the interprovincial NGL pipelines, and Table S8.8 lists the proposed NGL pipeline projects.