The AER releases its annual Alberta Energy Outlook report amidst an uncertain backdrop

Alberta - June 24, 2020How can you take aim effectively at a constantly moving target when everything around you is shifting faster than you can say “unprecedented times?”

That’s the challenge economists with the Alberta Energy Regulator (AER) faced when developing the organization’s annual reserves and supply outlook report, ST98: Alberta’s Energy Outlook.

“Everyone who produces these types of future-looking reports was scrambling this year trying to keep up with the latest information,” says Afshin Honarvar, principal economist with the AER.

“Just when we thought we had it figured out, something else would change and we’d essentially have to start over. It was the butterfly effect, on repeat.”

The same but different

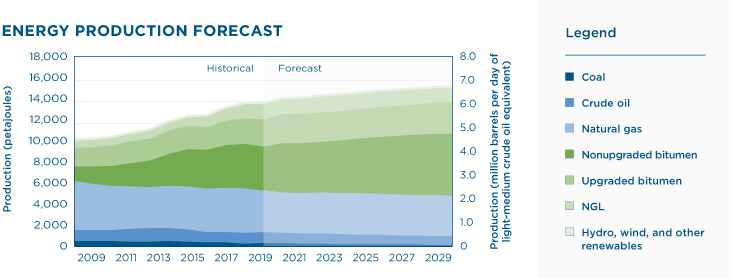

The Alberta Energy Outlook report is one of many reports the AER produces each year. The report includes commentary on how our energy reserves are produced and used, as well as an economic forecast.

The AER provides analyses on various resources, like coal and natural gas liquids (NGLs), in addition to information about the oil sands sector with consolidated project updates and trends. The reserves and supply outlook report also allows readers to customize their data and create unique figures to best suit their analytic needs.

Talk of the town

In previous years, people would turn to the Alberta Energy Outlook report to get the latest information on what was happening in the energy industry and to better understand where the sector was heading economically. However, with headlines across the country touting global price wars, price differentials, and even negative prices, Alberta’s energy industry was a topic discussed at many dinner tables allowing for few surprises in this year’s report.

“On top of everything that was going on, and still is going on to a degree, it’s been one of the most challenging environments to get an accurate analysis,” explains Honarvar. “And to top it all off, COVID-19 happened and complicated things beyond our wildest imaginations.”

While looking back to look forward may seem like it is all doom and gloom, the good news is that globally, the demand for oil is starting to increase. As countries look to re-open their economies as part of their COVID response, Alberta markets will benefit in due course.

And to top it all off, COVID-19 happened and complicated things beyond our wildest imaginations.

Afshin Honarvar, Principal Economist

“Despite continued market access constraints and policy uncertainties, Alberta prices and production generally improved year-over-year in 2019,” says Honarvar. “It will be a slow road to recovery, but we’re already starting to see signs that there’s a light at the end of the tunnel, even if we can’t see the light just yet.”

External News Coverage

Energy Industry Spending Down 31 Per Cent in 2019; To Decline Further For 2020: AER

Daily Oil Bulletin | June 9, 2020

WCS Expected to Average US $19/bbl in 2020, Says AER

Daily Oil Bulletin | June 9, 2020

Kate Bowering, Writer