November 2025

Liability reduction occurs through closure work. There are two mechanisms in Alberta to reduce industry liability: the Orphan Well Association (OWA) and the Inventory Reduction Program (IRP).

To ensure that the OWA has an operating budget, the AER issues an annual orphan fund levy to licensees. In 2024, the levy was maintained at $135 million. The levy is in part used for closure costs when an energy company is unable to meet its obligations to safely and responsibly close its infrastructure. For more information, see our Orphan Energy Sites webpage.

The IRP focuses on licensee reducing their liability by bringing sites to full closure and increasing the amount of land returned to equivalent capabilities. The program has two components: closure nomination and closure quotas.

Closure Nomination

For closure nomination, eligible requesters can nominate sites for closure. To be eligible for the program, the well or facility must be in an inactive or decommissioned state for five or more years. Some of the sites that met these criteria and were not fully closed under the Government of Alberta’s Site Rehabilitation Program (SRP) were transferred to closure nomination. In all, 1332 sites transitioned from the SRP program to the closure nomination program in 2023. A total of $41.7 million has been spent on these sites.

In 2023, 62 sites were nominated under the closure nomination program, with a $374 000 spend reported. In 2024, 48 sites were nominated for closure under the closure nomination program, with a $1.46 million spend reported.

Closure Quotas

For closure spend, the AER sets a minimum amount of money that industry must spend on closure activities each year to ensure that licensees are focusing on their closure obligations. The industry-wide closure spend requirement is then divided among licensees (their mandatory closure spend). When closure work (decommissioning, environmental site assessment, remediation, and reclamation) is completed, industry reports the costs to the AER. This information is used to assess whether licensees meet the minimum spend requirement, assess compliance actions (if necessary), and support updates to estimated liability values. In 2024, the industry-wide closure spend requirement was set at $700 million.

For more information, see Directive 088 and Manual 023.

Commodity prices are a significant factor in determining the annual industry-wide closure requirements. The AER completed an analysis of historical average commodity prices for oil and gas, comparing current commodity prices with the historical average. The analysis resulted in the following conclusions:

- For West Texas Intermediate (WTI) crude oil prices, the average 2024 price was $75.72 US$/bbl compared with the average price of $51.72 US$/bbl from 1970 to 2024. The 2024 WTI commodity price was much better than the historical average.

- For Henry Hub (HH) natural gas prices, the average 2024 price was $2.41 US$/MMBtu compared with the average price of $5.90 US$/MMBtu from 1994 to 2024. The 2024 HH commodity price was much lower than the historical average.

Before the introduction of closure quotas, the AER collected industry closure spend data through the voluntary area-based closure (ABC) program (2019 to 2021). See below for links to the previous highlight reports.

Closure Spend Summary 2022-2024

The financial expenditure for the various closure activities is referred to as “closure spend.” This section focuses on the industry-funded OWA spend and the eligible closure spend (as defined in Manual 023) reported by industry for closure quotas. Refer to the ABC highlight reports above for closure spend under the ABC program.

In 2024, the OWA completed $119 million in closure work. For more information, refer to the OWA annual reports, which summarize its fiscal-year performance.

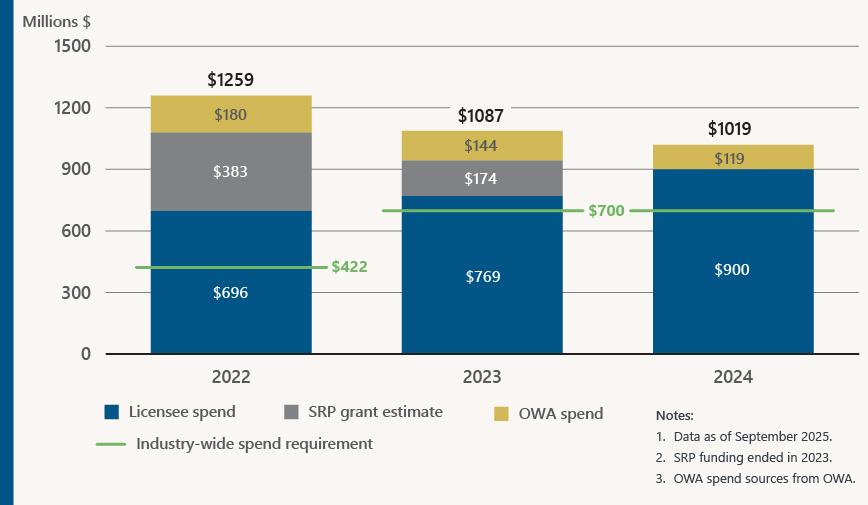

Industry reported eligible spending of $900 million, exceeding the requirement by 28%. Figure 10 shows the cumulative closure spend from the OWA and industry.

In total, $1 billion was spent on closure work in 2024.

Figure 10. Total closure spend and industry-wide spend requirements, 2022–2024

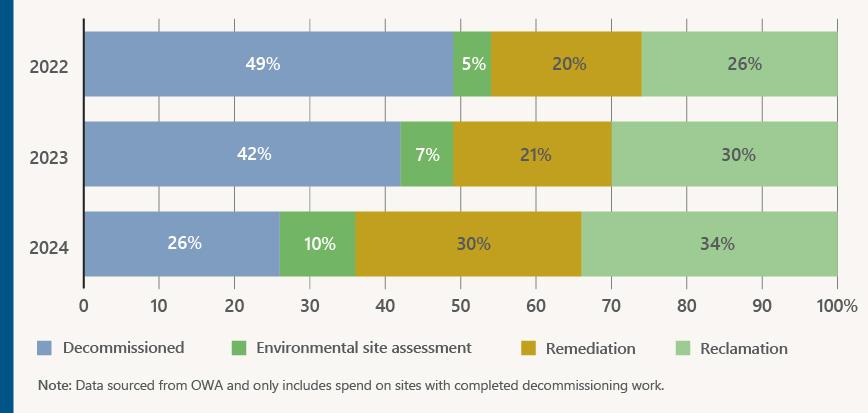

In 2024, the OWA continued to focus on remediation and reclamation, as shown in figure 11, with 34% of closure spend on reclamation activities.

Figure 11. Distribution of OWA spend by closure category, 2022–2024

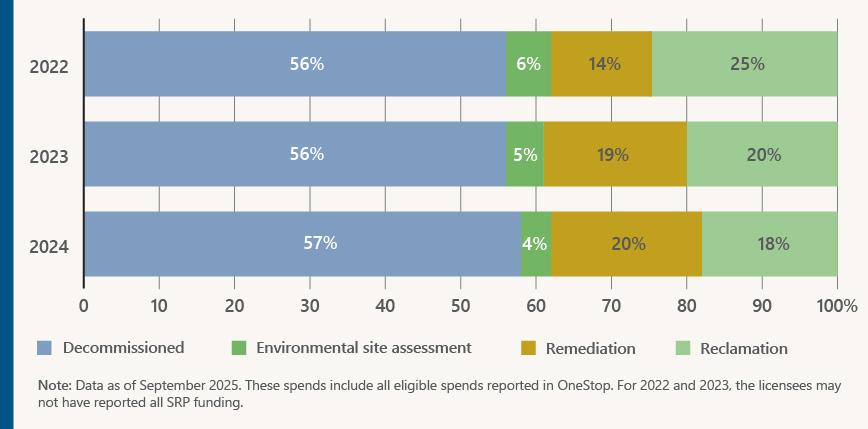

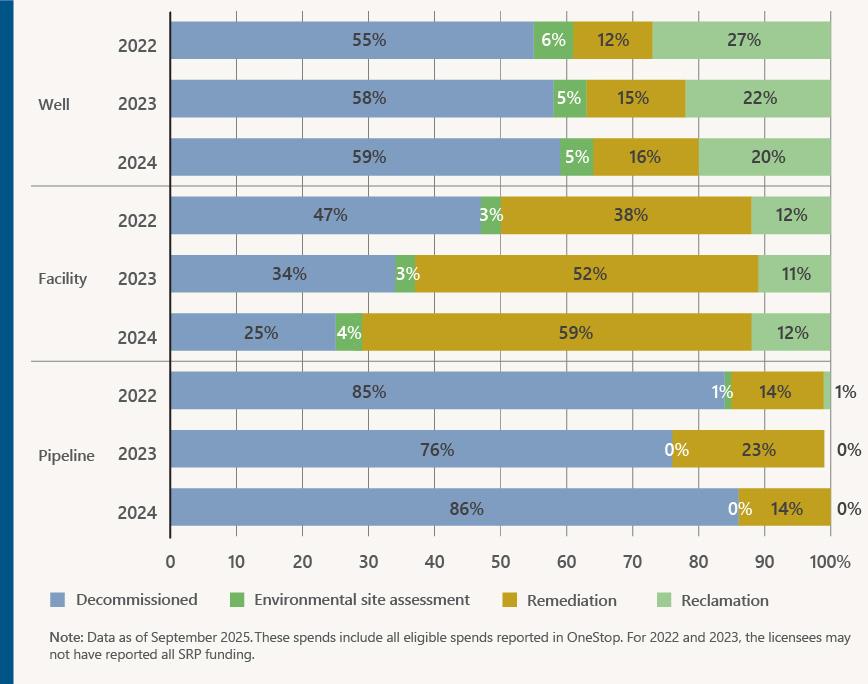

Licensees have consistently focused on closure decommissioning activities, as shown in figure 12, with less spent on reclamation activities in 2024.

Figure 12. Distribution of industry spend by closure category, 2022–2024

Evaluating licensee closure spend by infrastructure type, figure 13 shows the breakdown of closure spend in 2024 was similar to 2023 for wells and pipelines mostly on decommissioning. For facilities, we have seen a shift from more decommissioning activity in 2022 to more remediation activities in 2024.

Figure 13. Industry spend by infrastructure type by closure category, 2022–2024

Closure Activity Summary 2019–2024

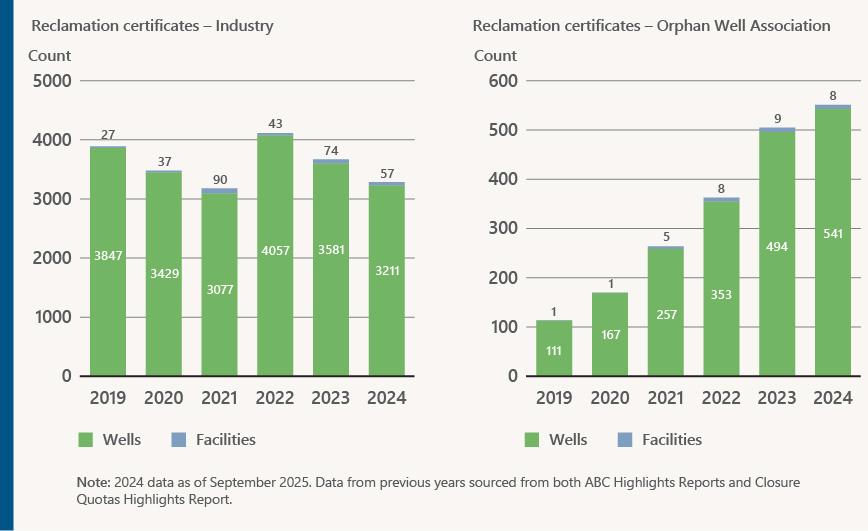

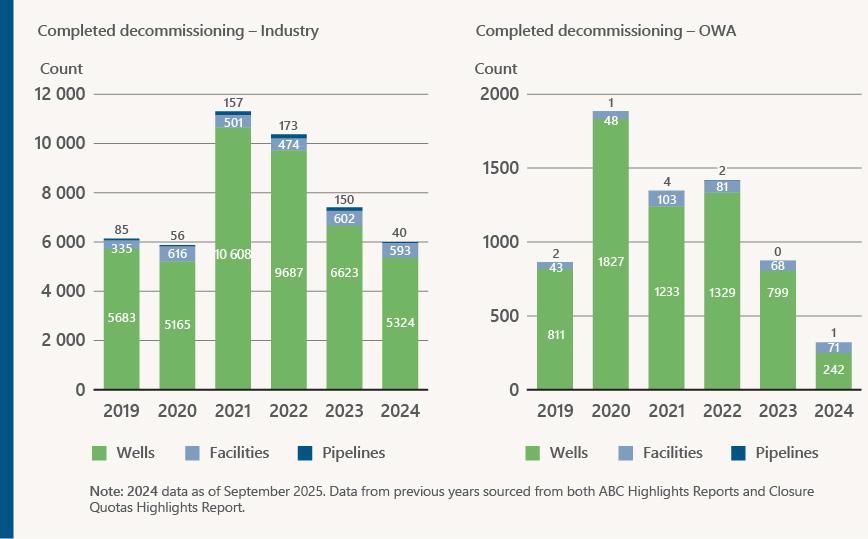

Figures 14 and 15 show the closure milestones achieved by industry and the OWA. Figure 14 highlights that between 2019 and 2021, closure work was primarily driven by the licensees participating in the voluntary ABC program, whereas activity since 2022 is related to closure quotas.

Funding from the SRP began in 2020. Most of the SRP funding (75%) was provided in 2021 and 2022, with the remainder at the start of 2023 (see figure 10). No SRP funding was provided for 2024. Most of the wells decommissioned by industry were in 2021 and 2022 (see figure 14), with a decrease in 2023 and 2024. While licensee spend has increased each year (see figure 10), the loss of SRP funding has reduced the total spending for 2024, with less decommissioned infrastructure. Similarly, the OWA results in 2024 show the same trend with the closure decommissioning milestone.

Figure 14. Industry and OWA decommissioning, 2019–2024

While the number of licensees receiving a reclamation certificate in 2024 declined from 2023, the OWA continued to increase its reclamation certification over the past five years (see figure 15).

Figure 15. Industry and OWA reclamation certification, 2019–2024