Updated June 2025

Summary

The number of new gas wells placed on production in 2024 decreased by 12.1% and included newly drilled wells placed on production and recompletions into new zones of existing wells. A significant decrease in natural gas prices reduced capital spending, while relatively high natural gas liquids (NGLs) prices supported drilling activity in the liquids-rich areas.

Figure S5.6 shows the historical numbers and base case forecasts of new natural gas wells placed on production and the Alberta plant gate price.

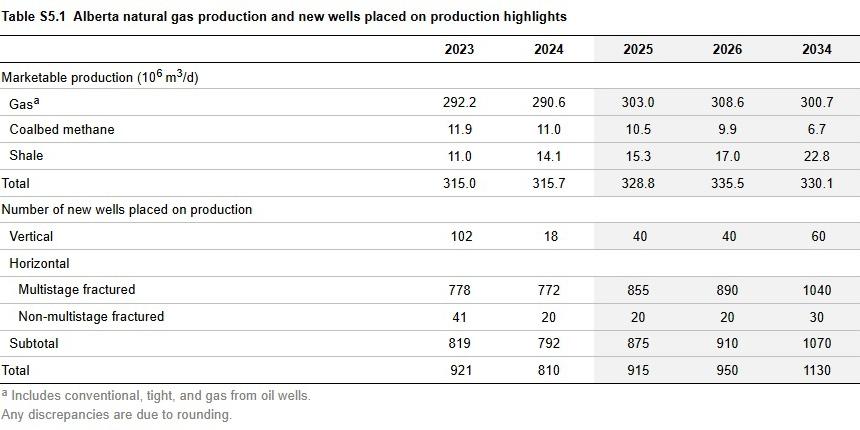

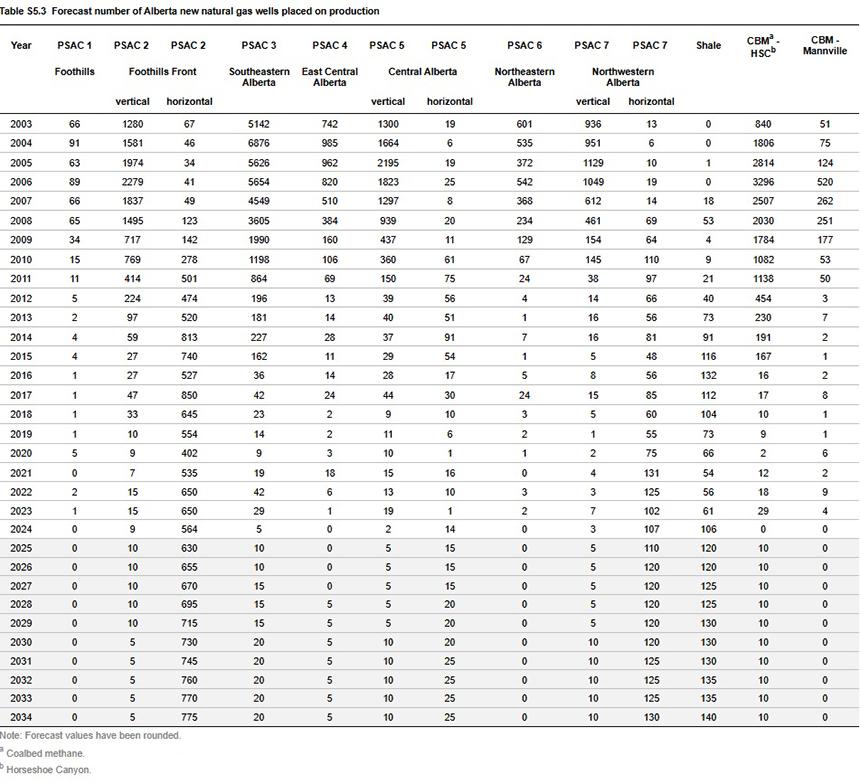

Well activity is shown by well type in Table S5.1 and by Petroleum Services Association of Canada (PSAC) area in Table S5.3.

Well Activity in 2024

In 2024, 810 natural gas wells were placed on production in Alberta (Table S5.1). Horizontal wells accounted for 98% of the new wells drilled, of which 97% were completed using horizontal multistage fracturing (HMSF), the dominant technology since 2011. These wells use long horizontal legs to reach across large sections of the gas-bearing formation, increasing their productivity.

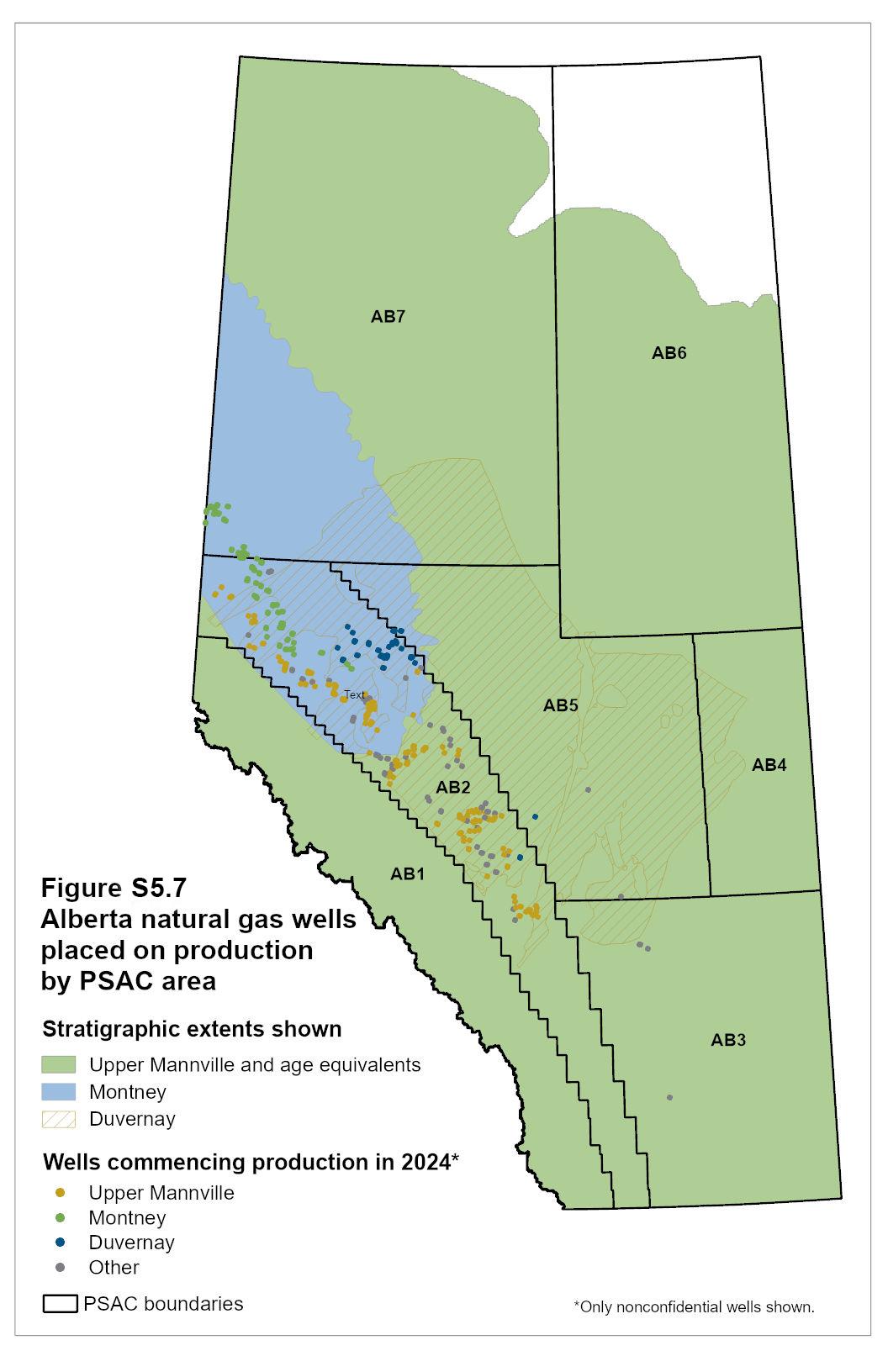

Nearly 87% of all new HMSF wells placed on production were in the Foothills Front (PSAC 2) and Northwestern Alberta (PSAC 7). These areas have the highest NGL content in the raw gas stream and the highest productivity rates. About 13% of all new HMSF wells placed on production were in shale formations.

Vertical wells typically target shallower formations with lower NGL content and generally have lower productivity rates than horizontal wells. In 2024, new vertical wells in the province were primarily in Southeastern Alberta (PSAC 3), Central Alberta (PSAC 5), and Foothills Front (PSAC 2). The number of new vertical wells placed on production decreased by 82.4% in 2024 because of the significantly lower price of natural gas last year and the increasing productivity of horizontal wells.

Table S5.1 shows Alberta’s average daily marketable gas production and the number of new wells placed on production by year.

Figure S5.7 shows the distribution of wells starting production in 2024 by PSAC area.

Base Case Forecast for 2025 to 2034

The number of wells placed on production is expected to increase in 2025 and will keep growing moderately over the forecast period. A recovery in natural gas prices, plus a positive outlook for natural gas demand, will support this increase.

We estimate 1130 new wells to be placed on production by the end of the forecast period, representing a 39.5% increase from 2024. Around 92% of the new wells are expected to be HMSF wells concentrated in the Foothills Front, Northwestern Alberta, and shale areas.

PSAC 2, 5 and 7 and shale will continue to be the focus of new gas developments in the province. The high NGLs content of the gas and the high productivity of the new wells are key to their appeal, plus accessibility and availability of the processing and transport infrastructure and the continued consolidation of operators in these areas.

Table S5.3 shows the forecast number of new wells placed on production by PSAC area.

One-Year Tariff Scenario (Tariff Case)

If tariffs are imposed, there would be some effects on wells placed on production. Increased uncertainty will discount local natural gas prices; higher material and drilling equipment costs and reduced investment will affect drilling plans. Compared with the base case, tariffs would lead to a 4.4% decline in the number of new wells placed on production in 2025, resulting in 875 wells. Although the number of new wells is expected to rise to 1100 wells in 2034, this number would still be 2.7% below the base case.